FX News Today

European Fixed Income Outlook: The 10-year Bund yield is down -0.3 bp in early trade at 0.624%, the 2-year is down -0.2 bp at -0.590%. Peripherals are outperforming at the long end, but the picture is more mixed in the 2-year area. Eurozone stock futures are moving higher, in tandem with U.S. futures, UK100 futures are in the red, after a mixed session in Asia. Data releases remain thin on the ground and investors are looking to US inflation data for guidance on the pace of Fed tightening. In Europe, Brexit speculation ahead of the March 22-23 summit, ECB speak and the SNB’s policy review remain in focus.

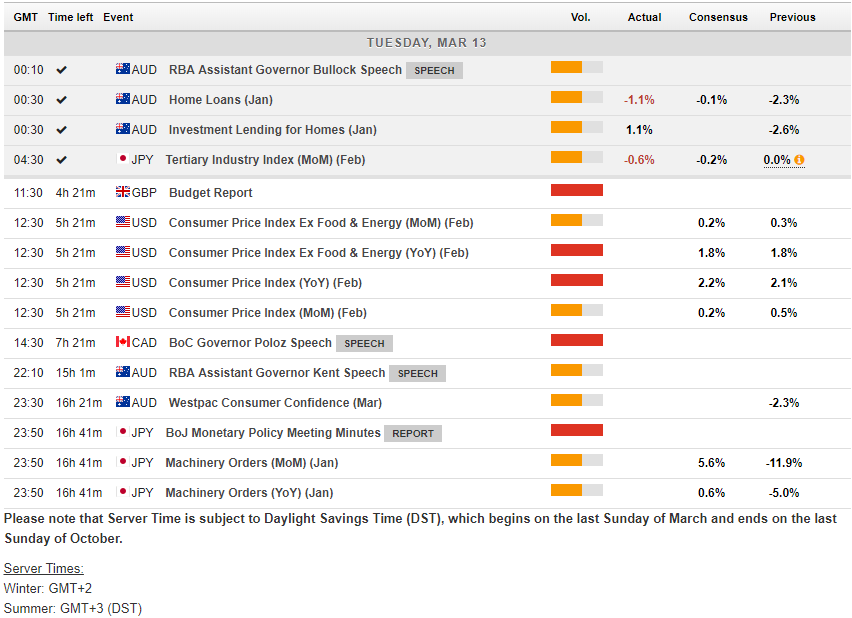

FX Update:The yen back out of early-Tokyo highs and is showing an average 0.4% decline versus the dollar and euro heading into the London interbank open. USDJPY logging a high of 106.90 after posting a three-session low at 106.25. EURJPY also lifted out of a two-session low to make a two-session high of 131.77. AUDJPY and other yen crosses saw a similar price action. The dollar, meanwhile, traded with a steady-to-firmer tilt with markets eyeing today’s release of the U.S. CPI, a data series that has been having a relatively heightened influence on markets as the participants look to fine tune their Fed policy expectation. EURUSD has ebbed to the 1.2325 area, moderately lower from a 1.2345 two-session high that was seen in early Tokyo. As for the yen’s weakness, this has come despite a flagging bullish sentiment in global equity market, though in the bigger view the Japanese currency yen has been trading in a relatively narrow sideways pattern over the last week, and USDJPY is near to the midway point of the range that’s been seen over the last month. Japan’s finance minister Aso is likely to skip next week’s G20 meeting due to the alleged embroilment of the Ministry of Finance with a state land sale scandal. In data, Japan’s tertiary index contracted by 0.6 % m/m, worse than the -0.3% median forecast.

Charts of the Day

Main Macro Events Today

- UK Budget Report

- US CPI and Core CPI – It is set to increase by just 0.1% for both headline and core, which should keep the core y/y pace unchanged at 1.8%.

- BOC Gov Poloz Speech – Bank of Canada Governor Poloz speaks on “Today’s labor market and the future of work.” The text of his prepared speech is available 10:15 ET on Tuesday.

- RBA Assist Gov Kent Speech

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/13 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.