AUDUSD, H1

The dollar has traded steady-to-softer in early-week trading so far. The market was rocked a little by demands for the resignation of Japan’s finance minister, Aso, who subsequently said that he would stand his ground. The intrigue is linked to a political scandal involving Aso’s Ministry of Finance and a sale of state land, though the episode has had little impact on stock markets, with the Nikkei 225 closing up by 1.8%, outperforming most Asian markets, which were in bullish mood following Friday’s “Goldilocks” U.S. employment report. The cooling in tensions on the Korean peninsular is also in the mix of sentiment influences, with Pyongyang reportedly wanting to sign a peace treaty with the U.S.

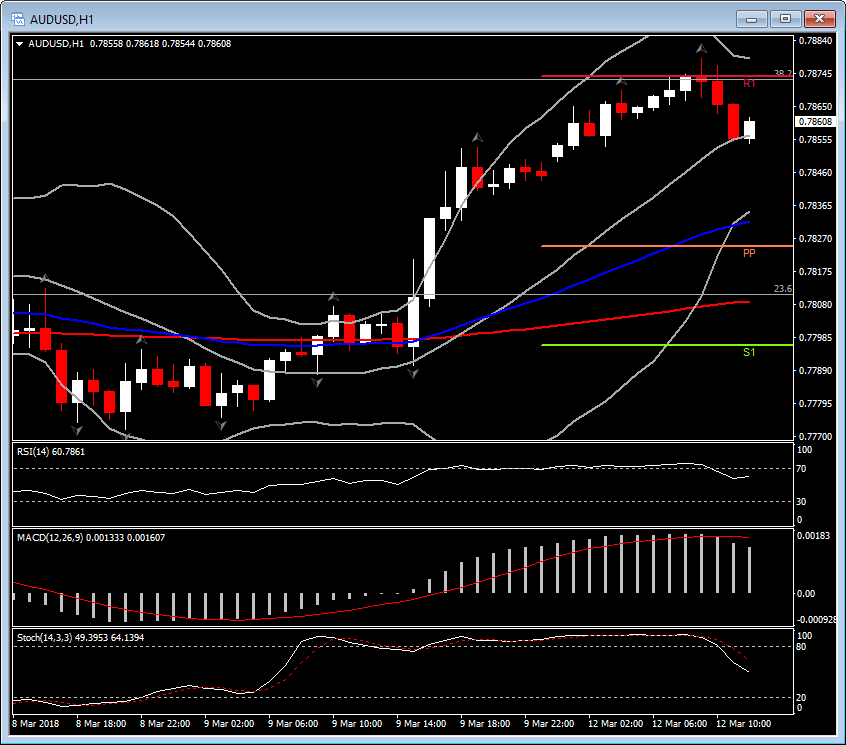

AUDUSD and NZDUSD are showing the biggest movement out of the main currencies, with the former up 0.3% and the latter up by 0.5%, with the currencies benefiting from the risk-on vibe. AUDUSD logged a two-week high of 0.7875, but today it reversed on London open, down to 0.7858. It seems that the pair found resistance at 38.2% Fibonacci retracement level since January’s decline, at 0.7873. The pair presents a downwards pressure in short-term, after the reach of the 20-period MA in the hourly chart. This weakness could be confirmed, if we face a crossing to the lower Bollinger Bands pattern in the Daily chart as well, i.e. price action back below below 0.7835.

The short-term technical indicators are mixed, with MACD strongly remaining to the upside, while its lines suggest strong momentum, RSI drifted lower to 57 but it is currently flattening above neutral, while oppositely with the rest, Stochastic is at 45, suggesting more weakness in the market in short term. However,the latest 3 candles along with the fact that the latest one was a full body candle, confirms the weakness in short-term. The next downside target is at the 50-period EMA, at 0.7830, with support at today’s high, only if the pair manage to cross below the 20-period MA in the hourly chart. A rebound from the 20-period EMA, could triggered an upside target at 0.7885, with support at 0.7847.

In a bigger picture, the pair remains in a upwards trend, after breaking the Falling wedge pattern on Friday. The RSI complies with pair’s action and it is seen sloping positively since March 1, MACD remains above neutral, while Stochastic is at the overbought territory. If the pair return to today’s highs, then it is likely to retest the next resistance area at 0.7890, with support at 0.7840.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/13 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.