FX News Today

European Fixed Income Outlook: The 10-year Bund yield is up 1.3 bp at 0.651% as of 7:20GMT, French 10-year yields are also up amid a wider rise in long yields, with 10-year JGBs up 0.046% and 10-year Treasury yields up 0.2 bp. Stock markets continued to bounce back in Asia as investor fears of a global trade war receded and the RBA left the cash rate unchanged and sounded slightly less optimistic on its growth projections. Italian 10-year yields are slightly down and below the 2% mark and it seems the messy Italian election result won’t lead to a wider crisis in Eurozone bond markets. Stocks meanwhile continue to recover and European stock futures are moving higher with U.S. futures after a positive session in Asia, where the Nikkei closed with a gain of 1.79%, ASX 200 rose 1.14% and the Hang Seng and CSI 300 are up 2.26% and 1.21% respectively. Meanwhile, Oil prices are also higher with the front end WTI future trading at USD 62.68 per barrel. Trump said he’s not backing down on tariffs in the steel and aluminum sectors, though Mexico and Canada want to talk about them in the context of NAFTA. Trump suggested that if the U.S. can make a good deal on NAFTA, then the tariffs can be addressed for Canada and Mexico. He said the biggest problem on trade is China and he doesn’t think there will be a trade war inspired by the steel and aluminum tariffs.

FX Update: The dollar majors have been in consolidation mode. with EURUSD, USDJPY, Cable, AUDUSD, along with the main crosses, including EURJPY, GBPJPY and AUDCAD, trading at near net unchanged levels as the London interbank market takes to its collective desk. This has come amid a backdrop of recovering global stock markets. EURUSD has traded on either side of 1.2350, drifting lower in the latest phase, to around 1.2335. The pair has held below the 13-day high seen yesterday at 1.2365. USDJPY settled lower, back around 105.20 after scaling to a three-session high in the wake of the Tokyo fixing. EURJPY and other yen crosses saw a similar price action, posting fresh highs before turning lower.

Charts of the Day

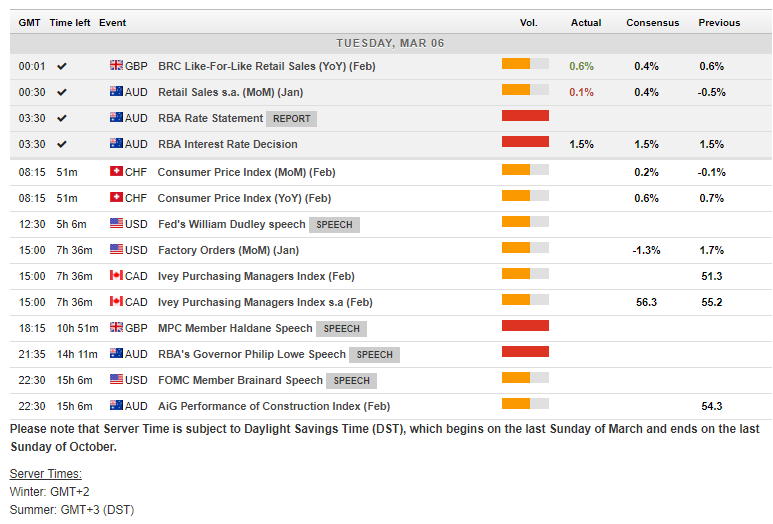

Main Macro Events Today

- Swiss CPI – expected to rise at 0.2% from decline seen on January.

- FOMC Member Dudley Speech – takes part in a round-table on the U.S. Virgin Islands recovery effort.

- Canadian Ivey PMI- Canada’s Ivey PMI expected to rise to 56.3 after falling to 55.2 in January on a seasonally adjusted basis from 60.4 in December. The Ivey remains consistent with an expanding economy.

- MPC Member Haldane and RBA Gov Lowe Speaks

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/06 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.