EURUSD, Daily

Eurozone unemployment at 8.6% y/y in January, unchanged from December, which in turn was revised down from 8.7% reported initially. The jobless rate is far below the long term average of 9.6%. Eurozone Feb manufacturing PMI revised up to 58.6 from 58.5 reported initially. National data was mixed, with the German reading revised higher, the French revised down. Despite the dips survey compiler Markit still reported broad based expansion seen across all nations and sub-sectors and highlighted that selling price inflation accelerated to an 82-months high, despite the slower increase input costs. So both the hawks and the doves at the council will find something to argue with in the report ahead of next weeks ECB meeting, although with market volatility remaining high and the EUR firmly above 1.20 to the USD Draghi and the top dogs at the ECB will likely want to wait until June before deciding on the future for QE.

The final manufacturing PMI for the Eurozone had a little impact on the euro, while the dollar has retained an underpinning amid a backdrop of shaky global stock markets, with investors cutting out of risk assets, and revamped Fed tightening expectations following the congressional testimony before the House Financial Services Committee of new Fed Chairman Powell earlier in the week. Powell will appear again today, this time before the Senate Banking Committee, where some market narratives have ruminated on the risk that he may walk back some of the hawkish interpretations of his communication on Tuesday, which in the event would likely spark a downward spin on the dollar.

EURUSD edged out fresh six-week low of 1.2179, surpassing the Asia-session low by 4 pips, though the net change on the day remains moderate. It is widely expected that Powell will repeat is base optimism on U.S. growth prospects, and therefore it is most likely that EURUSD will remain in a bearish movement. Price action this week has affirmed a bear phase that’s been in evolution for two weeks now.

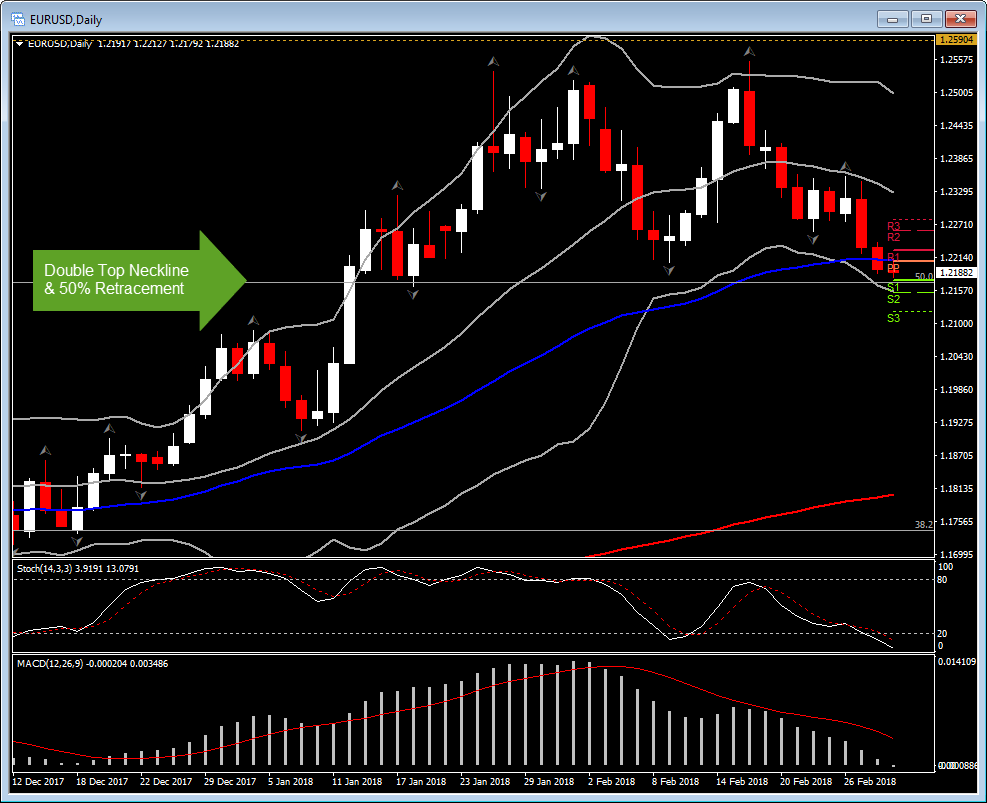

Nevertheless, significant is the fact that the pair is currently traded close to the 50% retracement since the 2014 sharp decline, at 1.2170. This key level confluence with the neckline of a double top formation noticed in a Daily chart from January 15, up-today. Hence a string break below this level, could alert a bearish signal. However, a return back to 1.2260-1.2280 resistance area, indicates the possible retest of 1.2400 and 1.2500 round levels.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/01 12:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.