USDCAD, H1 and Daily

Canada CPI slowed to a 1.7% growth rate in January (y/y, nsa) from the 1.9% pace in December. CPI surged 0.7% on a month comparable basis (m/m, nsa) after the 0.4% drop in December. The annual and month comparable growth rates overshot projections (median +0.5%, +1.5%), realizing the upside risk around this report. A 7.8% bounce in gasoline prices during January relative to December drove the CPI higher. The slowing in the annual growth pace was due to an easy comparison with an elevated January of 2017 level. As for the core measures, the CPI-trim grew 1.8% y/y from a revised 1.8% (was +1.9%), the CPI-median expanded at a 1.9% clip from 1.9% and the CPI-common grew 1.8% from 1.6%. While an easy annual comparison muted the annual price gain in total CPI, this report underpins expectations for more rate hikes from the BoC this year. However, disappointing growth and employment data are consistent with a cautious, gradual approach to rate increases. Two more 25 bps moves this year, in July and October, are widely anticipated.

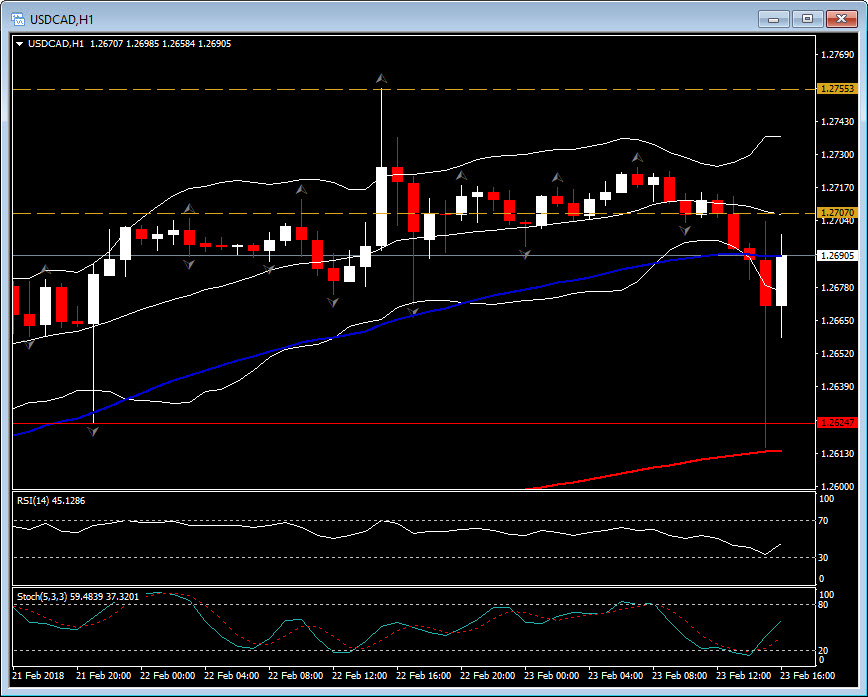

All Canadian crosses traded on the direction pointed by the strong Canadian CPI data. The beat on CPI expectation, encouraged USDCAD bears to push Loonie back to 61.8% retracement Fibonacci level from December fall, by breaking the immediate support level at 1.2624, which was Wednesday’s low and last week’s strong resistance level. However a bearish signal and a possibility of a trend reversal in a Daily timeframe, could turn our attention, only on the break below the next support level at 1.2550, but ultimately on the break below the 20-DAY SMA, at 1.2510.

Meanwhile, the short term picture is positive despite the bearish long legged candle seen on the data release. The recent hourly candle is formed by a small body and a long down leg, suggesting that there is limitation to the downwards momentum. Momentum indicators confirm this scenario of an ending of the down movement shortly. In the hourly chart, RSI popped up from the oversold territory, and stochastic slopes above neutral zone. The MACD signal line is still moving above neutral, while the MACD histogram (presenting the strength of the trend) is weak. Currently, the pair is traded back inside the Bollinger Bands pattern.

Therefore, this spike lower on the data could be consider as a corrective move on this long term upwards move of the Loonie since February 2. Next intra-day Resistance levels come at 1.2710

(20-period SMA in th ehourly chart and 200-DAY SMA in the daily term) and 1.2750. Meanwhile support is at today’s low, at 1.2615.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/02/27 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.