FX News Today

European Fixed Income Outlook: Asian markets headed south in tandem with U.S. futures, after sentiment turned sour once again during the European session yesterday and yields resumed their uptrend. The Topix closed with a loss of -0.7265, after gaining more than 2% yesterday. The Hang Seng was down -0.23% as of 6:40GMT, while mainland China remained closed for a holiday. EGB yields moved broadly higher at the start of the week, with core markets outperforming and stock markets correcting as risk aversion picked up again. Trading was quieter than usual with U.S. and Canada on holiday and Hong Kong and China among others closed during the Asian session. Japanese stocks still managed to rally, but while European markets opened slightly higher, they quickly pared gains and as of 15:44GMT the GER30 was down -0.40%, the UK100 down -0.51%. Italian stock and bond markets underperformed as the election casts is shadows. The 10-year Bund gained 2.8 bp today and is at 0.73%, the Gilt is up 1.6 bp at 1.597%, while the Italian 10-year is up 6.8 bp at 2.044%. The short end outperformed and 2-year yields are down -0.1 bp in Germany and up a mere 0.7 bp in the U.K., leaving the curve steeper. Traders are looking to U.S. auctions and FOMC minutes for the Jan meeting for direction, as markets remain volatile amid the gradual withdrawal of central bank support. European finance ministers gathered for Eurogroup and Ecofin meetings but with Ireland withdrawing of central bank head Lane for Constancio’s position as vice president the way is free for Spanish economy minister Guindos to take over.

FX Update: The dollar continued to hold firm, extending the same theme for a second day. This came with 2-year U.S. Treasury yields rising to a near 10-year high in Asia today, and with stock market sentiment having soured somewhat following a week-long rebound. The USD index (DXY) posted a four-session high of 89.44, extending the rebound from Friday’s 37-monnth low to 1.4%. EURUSD remained heavy after logging four-session low at 1.2369 yesterday. USDJPY lifted for a third straight session, this time logging a four-session high of 106.95, extending the rebound from the 15-month low seen last Thursday at 105.54. EURJPY and other yen crosses are also firmer, though by a lesser magnitude than USDJPY with a broader bid in the dollar also been at play. The yen’s past inverse correlation with stock market direction has remained absent, with equity markets in Asia turning lower today, following the souring in sentiment that was seen during the PM session on European bourses yesterday. The dollar also traded firmer versus the likes of the baht, Singapore dollar and rand, along with most other newly developed and developing-world currencies. One exception was the Australian dollar ,which outperformed today, posting a 0.4% gain versus the yen, and a 0.2% rise against the U.S. buck.

Charts of the Day

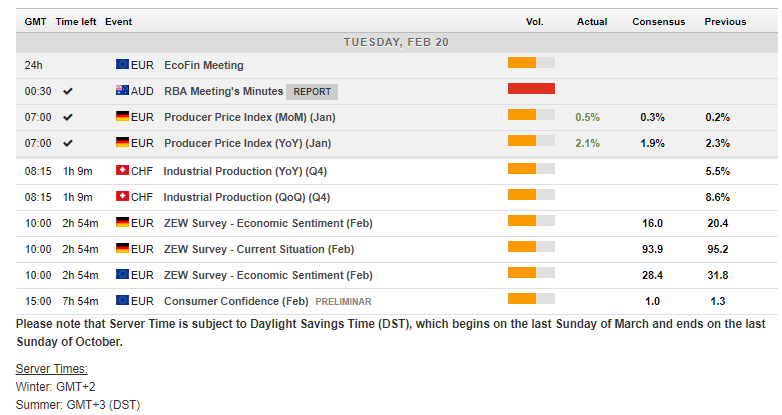

Main Macro Events Today

- German ZEW Economic Sentiment – a dip in the German ZEW Investor Sentiment expected to 16.2 from 20.4 in January.

- EU Consumer Confidence – is expected to correct to 1.0 from 1.3 in January.

- NZ GDT Price Index

Support and Resistance levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/02/20 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.