EURUSD,H1

EURUSD has come off the boil of logging a two-week high at 1.2510. Option related selling has been in the mix, helping drive the pairing below 1.2480. The dollar has also staged something of a broader rebound, which has seen USDJPY climb above 108.50 and tip lower from two-week highs. Recent dollar declines, notably in the cases against the yen and Australian dollar, have come despite markedly favourable shifts in the U.S. buck’s yield advantage, but this also is generating market narratives about buying dollars for the longer term. Much will depend on global asset market performance. If risk-on conditions persist in the face of heightening Fed tightening expectations, then the dollar will likely remain on a downward path as investors seek out higher beta, higher yielding assets. But if we see fresh bout of risk-off, the dollar is likely to rally.

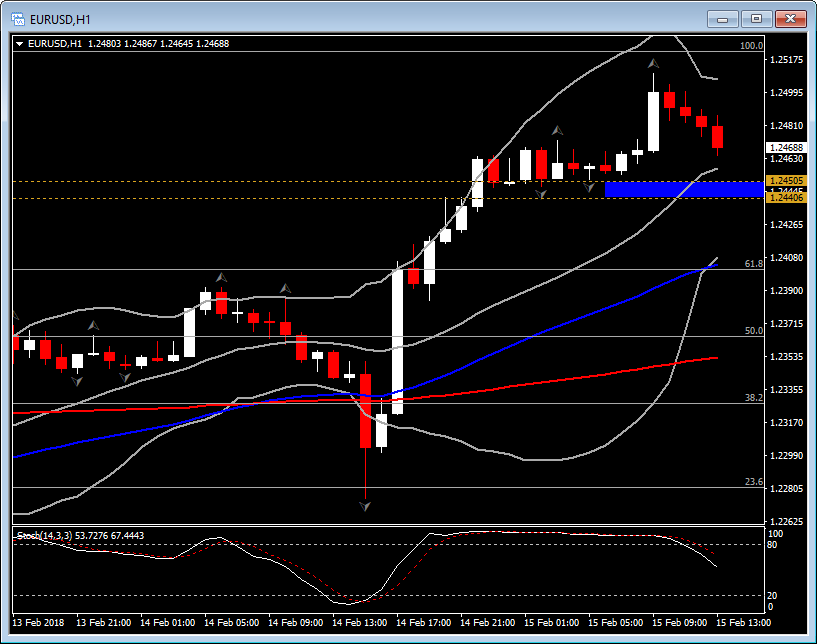

The EURUSD, today is at nearly full retracement from the drift seen the first week of February, therefore despite the strong Euro and the weakness seen on US Dollar, in short term is likely to see the pair making a correction from the sharp rally seen since yesterday. The key level however in order to claim that the downwards correction scenario is indeed possible is a break of the intra-day support at 1.2440-1.2450 area, which is the area of the last 2 low fractals seen in the hourly chart. A break below this area, will triggered a short position with targets at the low Bollinger Bands pattern and the 61.8% Fibonacci Retracement level, at 1.2420-1.2400 area. Intra-day Momentum indicators are mixed, with Stochastic slopping lower, indicating negative momentum, while AMCD remains positive since February 9th.

Oppositevely, with the bigger picture remaining bullish, a hold above this support area mention above, will give the confidence of another test higher up to the January 25th and February 1st highs at 1.2537 and 1.2523, which are the highest levels seen since December 2014, provide the upside targets. Daily momentum indicators indicate the continuation of the upwards movement.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/02/20 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.