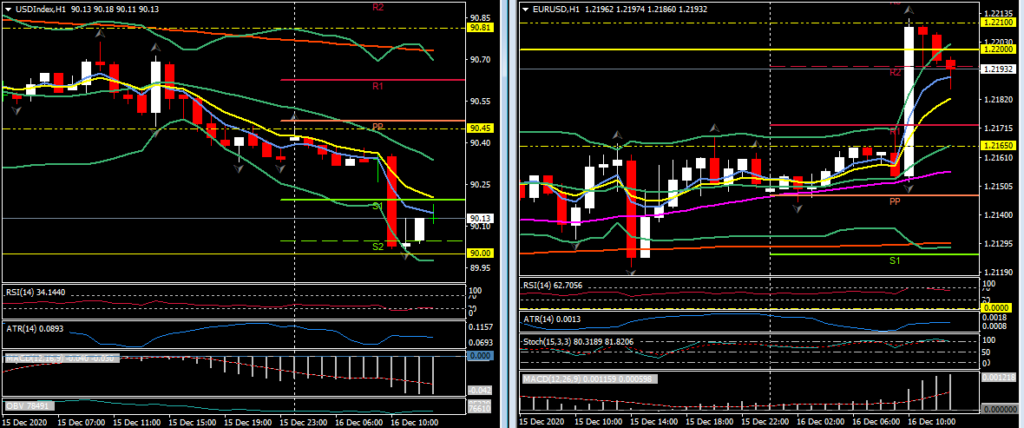

EURUSD, H1

Eurozone & UK Dec. PMIs were generally stronger than expected, with the exception of UK Services. EU Services sentiment in particular rebounded, even in Germany, which is going into a stricter form of lockdown today, which will see shops closing. The Eurozone Services PMI still suggests contraction at 47.3, but that is a marked improvement compared to the reading of 41.7 in November. Manufacturing sentiment rose to 56.6 from 55.3, which left the composite at a 2-month high of 49.8, which effectively suggests stagnation rather than contraction. Markit commented that due to the improvement in December, the fourth quarter downturn is looking less steep than initially feared. Still, as Markit also highlighted – while the prospect of vaccinations is underpinning future expectations, in the near term the environment remains challenging for many consumer-facing companies.

In the UK Markit noted that “The UK economy returned to growth in December after the lockdown-driven downturn seen in November, adding to signs that the hit to the economy from the second wave of virus infections has so far been far less harsh than the first wave in the spring.” The recovery lacked vigour, however, as the service sector remained under particular strain, contracting marginally again as ongoing social distancing measures due to tiered lockdowns continued to hit many parts of the economy. Manufacturing numbers were 57.3 vs 55.9 with last month’s number being increased to 55.6, while the more important Services slipped below the key 50.0 level to 49.9 and missed expectations of 50.5, with last month’s data also being upgraded to 47.6, but remaining historically very low.

The USDIndex has remained heavy, testing a new 32-month low at 90.05. EURUSD has concurrently been holding firm, breaching its 32-month highs at 1.2178, to push to 1.2210. USDJPY, now amid its fourth down day out of the last five, has ebbed to a five-week low at 103.25. As we have noted before, real interest rate differentials are imparting a bias for the Yen to gain on the Dollar, albeit modestly. The nine-month lows, seen last month at 103.17-19, are back in scope. There looks to have been a degree of position trimming in CADJPY, which has been a popular long lately, being a strong correlate of the reflation theme in global markets. The cross is showing a decline of nearly 0.5% on the day so far. USDCAD, meanwhile, has lifted back above 1.2700 to 1.2745 after yesterday printing a 32-month low at 1.2686. While oil prices have been remaining perky, with Brent benchmark prices sustaining gains above $50, upside momentum has been abating. OPEC supply is set to increase, in addition to recovering supply out of Libya, while Norwegian and US supply are also increasing. There are also expectations for Iran to strike a deal on its nuclear program with the Biden administration, which could lower sanctions that have been stifling oil exports out of the country. These supply fundamentals, along with the demand-sapping virus containing measures in many of the major northern hemisphere economies, look to be setting up oil prices for a year-end correction after six consecutive up weeks. Elsewhere, the Pound has remained buoyant, with markets factoring in prospects for the EU and UK to reach a future relationship deal as soon as this week. There hasn’t been much news from the negotiating teams, though this in itself is being taken as a sure sign that progress is being made after the EU’s von der Leyen said that a “narrow” path to agreement has come into view. Cable has printed a 12-day high at 1.3519.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.