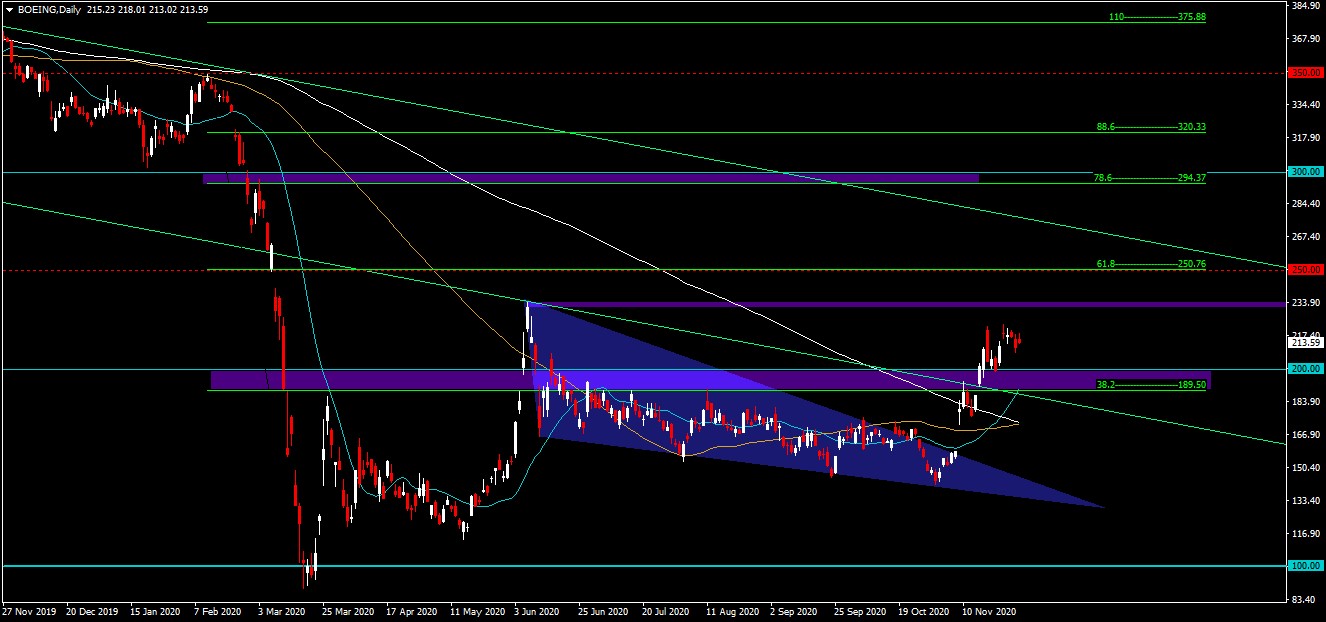

BOEING, Daily

The American multinational company Boeing Co. that designs, manufactures and sells planes, helicopters, missiles and satellites has been involved in controversial situations since before the coronavirus pandemic, due to problems with the 737 MAX aircraft models that were suspended and blocked from operations by air regulators around the world after suffering two accidents in a six-month period, one in Indonesia and one in Ethiopia, in which a total of 346 people died.

But regardless of the volatility that has characterized 2020, Boeing has recovered somewhat from its lows, adding a lot of value as one of the most important companies in the United States and the world, given its duopoly with Airbus and consolidating itself as one of the major supply chains in the world, making it a valuable long-term bet.

Boeing has a market capitalization of $122.85 billion and a final 12-month PE ratio of 0, while in terms of its 52-week price range, BA has a high of $374.77 and a low of $89.00. The company’s stock has gained about 46.15% in the last 30 days, leading to analyst estimates that expect earnings per share (EPS) of -$0.96, with EPS growth for the year declining to -$8.95 for the current year and $1.49 for the next one, representing a growth of 1.58% and –1.17% in EPS for the two years respectively.

Similarly, the consensus growth in revenue is estimated at $16.57 billion with a minimum of $13.51 billion and a maximum of $21.59 billion. With these figures, the median projection represents a growth of –7.5% compared to the growth in sales that has been increasing since the quarter corresponding to one year. On the other hand, the PEG ratio for BA shares is currently at 0, and the current price level is 18.82% of its SMA20 and 27% of its 50-day simple moving average.

The beta value is 1.7, while the average true range (ATR) currently points to 9.44; in turn, the average target price for the shares over the next few months is $207.26, with estimates that have a minimum of $125 and a maximum of $306, leaving prices with -42.26% and +41.34% discount on the current price level.

Boeing has established itself as an extremely important company when it comes to the global supply chain and the wellbeing of the population in general, since it connects a massive network of suppliers; last year it was the largest exporter of US manufactures. Its products cost hundreds of millions of dollars, as the airplane business has been a huge source of wealth, due to increased globalization and a rapidly expanding middle class with the desire to travel and discover the world.

Boeing’s current price is $236.77, testing past May highs after a bullish rally that began on November 2. The price has exceeded the moving averages of 21, 100 and 200 daily periods and currently these averages have a cross of the 100 and 21 to the rise above the 200. The price broke the resistance of the weekly Fibonacci level 38.2% at 188.66 and the psychological level of 200, after a bullish wedge. Currently, momentum continues and is closing the gap towards the 61.8% Fibonacci resistance at $250.20. On the other hand, we find support at Fibonacci 38.2 at $203.60 of the current momentum that creates a range to the psychological level of 200, the moving averages of 21 period at $197.59, of 100 period at $173.28 and that of the 200 period at $171.91.

Click here to access the HotForex economic calendar.

Do you want to learn how to trade and analyze the markets? Join our webinars and get analysis and a better understanding of how markets operate.

Aldo Weidner Z.

Market Analyst – HF Educational Office – Latam.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.