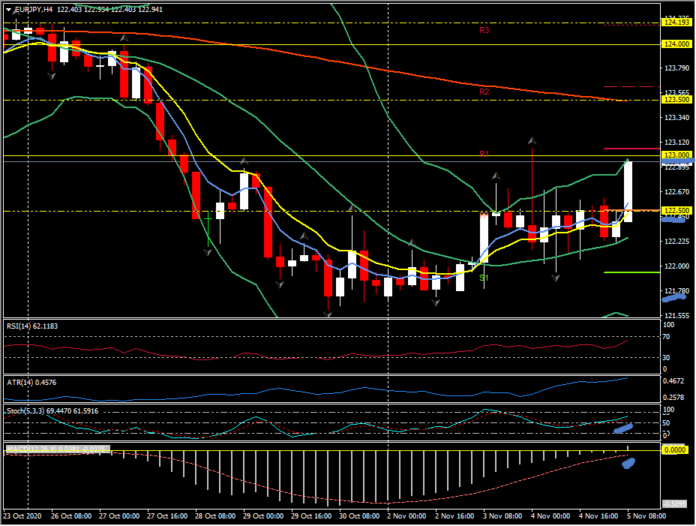

EURJPY, H4

Italy is the latest European country to announce new restrictions on Wednesday, with ministers approving a curfew. This action will limit the movements of Italians and keep them indoors between 22:00 and 05:00. The measures are less stringent compared to Germany and France, but the situation still does not bode well for the prospects for economic growth in Europe. Meanwhile, cases in Japan appear to be decreasing.

EURJPY has stalled from its recent decline and is trading near the resistance zone 123.00. The pair has been declining the last 2 months with a corrective wave of a gain of 114.42 which is closely related to the lockdown of parts of Europe and the US elections carrying the risk of safe haven. The Yen has been a safe haven currency in the last two decades and this will bring some support for the Japanese currency ahead of the US election results. Concerns of voting violence and drama and the lingering results of the tally could certainly create problems until a winner is announced. Stocks rallied strong on Tuesday, but less so yesterday as traders shifted from a possible Trump win, back to a Biden victory but with the Republicans holding onto the Senate. The Yen didn’t give up too much on the Euro because of the underlying virus problems.

On the economic front, the Yen also has an edge as the BoJ is likely to hold interest rates at -0.1% and although they may introduce some stimulus measures, the risk lies with the Euro, where the recent lockdown is likely to lead to slower growth and monetary policy moves. More aggressive action by the European Central Bank should see the Yen stronger in the coming weeks.

EURJPY has stopped around 122.50 levels and is limited below the neckline 123.00 trading range around 50 pips seen on the intraday and up to test the key level again today. It needs a definite close to show the next direction, however the bias still shows bear control below the 200 EMA and the price is currently consolidating between the 20 EMA and the 50 EMA. MACD is thinning on the neutral line which generally indicates prices ranging for some time to come.

Click here to access the Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.