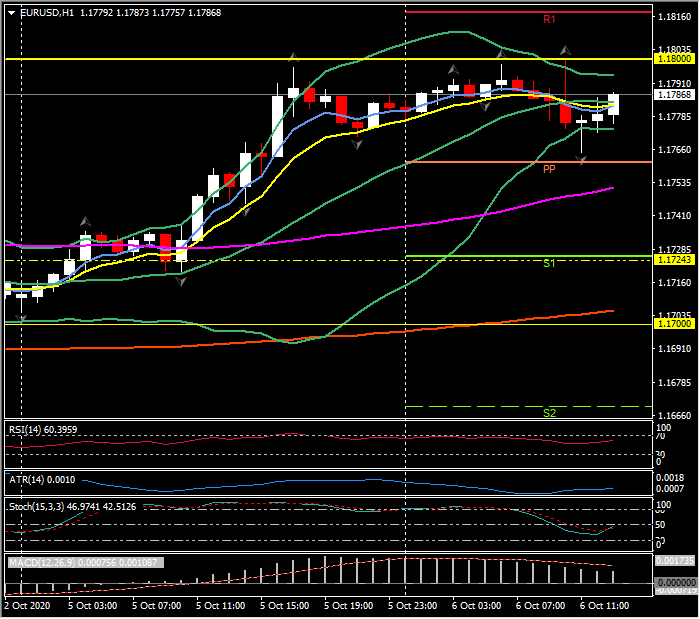

EURUSD, H1

ECB’s Lagarde seems to be laying the ground for a PEPP extension. While the current broader narrative has been focusing on the strengthening of the inflation target and thus the “low for longer” message, comments from Lagarde in an interview recorded last Thursday (October 1) and published today (October 6) also support expectations that the central bank is preparing for an extension of the PEPP program, most likely in December when the next set of forecasts are due.

The pandemic emergency purchase program, which temporarily lifts the cap on national purchases, is currently set to end in June next year and Lagarde flagged in the interview that there is the risk that the economy may not have recovered by then. Lagarde highlighted the resurgence of virus cases, saying that “instead of that V-shape that we all longed for and hoped for, we fear that it might have a second arm of the V”. Lagarde added that the ECB’s monetary measures are successfully complementing fiscal aid, but that the risk of a “cliff effect” from any sudden end to government support is what worries her most. The ECB President also stressed that the central bank is watching exchange rate developments, although the official line remains that the EUR is not a target in itself.

Also today, the ECB’s Makhlouf suggested that “average inflation targeting” is an option. The governing council member said monetary policy is making a big contribution and fiscal policy needs to step up so that fiscal and monetary policy work hand in hand. Nothing really new in the comments but the comments confirm again that against the background of negative inflation rates, the ECB is moving towards strengthening the “low for longer” message with an average inflation target that would commit the ECB to letting inflation run above target for a while, following the current period of underinflation.

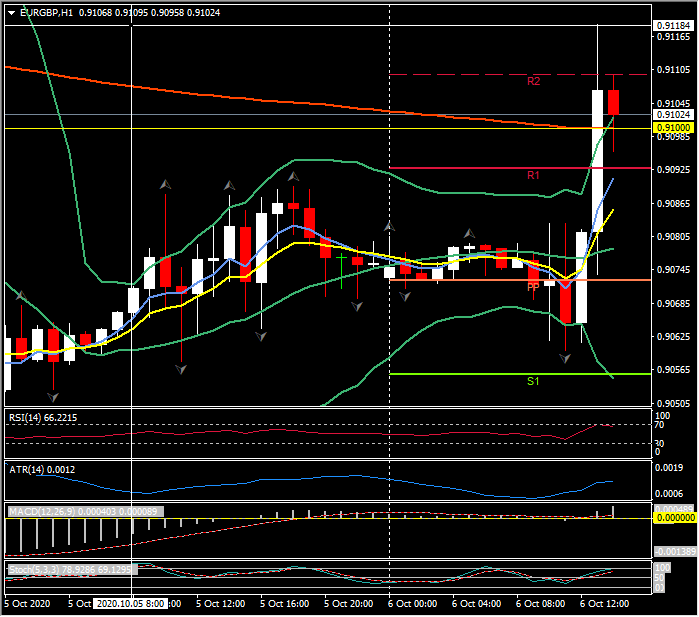

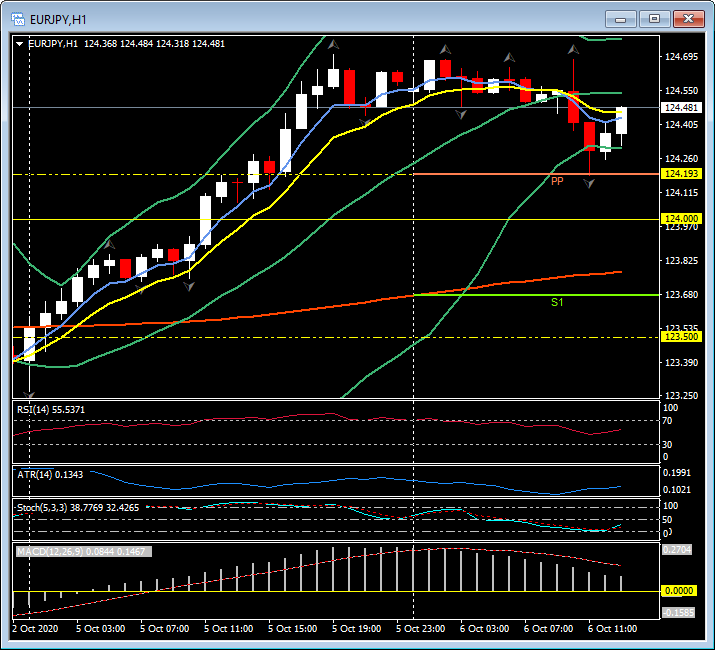

The Euro has been weaker today, and the combined comments have added to the downside with the EURUSD having rejected 1.1800 again, EURGBP falling to test 0.9060 before recovering to spike to 0.9118 (as sterling came under pressure) and even EURJPY was down to test 124.20.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.