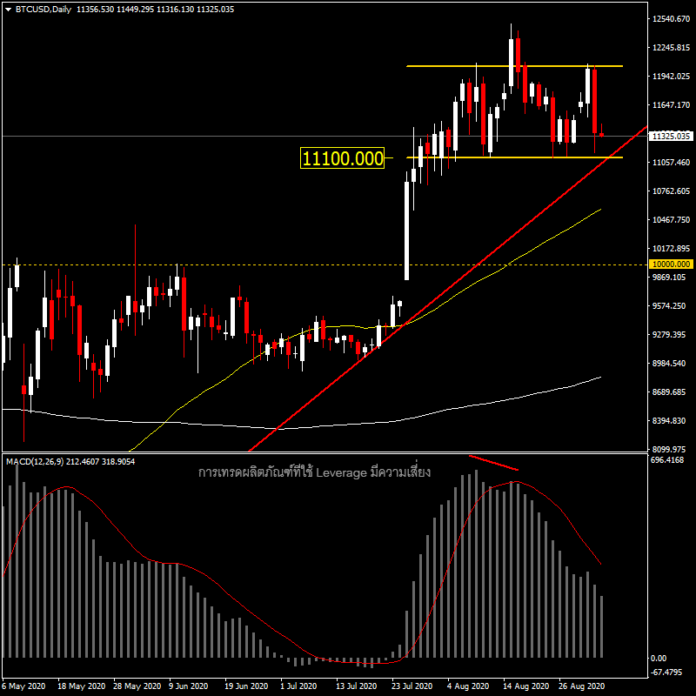

BTCUSD, Daily – Yesterday was another day when Bitcoin’s price fell from the $12,000 resistance zone to close down more than $640 as a result of an appreciation of the US Dollar overnight . Yesterday, the ADP Non-Farm employment figure came out lower than the market expected, which was double the previous release.

On the Daily timeframe, the bearish divergence seen since mid-August does not seem to have had the expected market response. Due to key factors such as the US Dollar, which was still depreciating at the time, however, yesterday’s drop in the Bitcoin price saw a trend of a potential reversal formation, a head and shoulder formation. A confirmation of this pattern could lead to the Bitcoin price falling back to $10,000 again. However, before the price can drop to the $10,000 level, there are still several support levels to break through, starting from the strong Support at the $11,100 price level (neckline), with another trend line being supported as well at the lower 50-DMA.

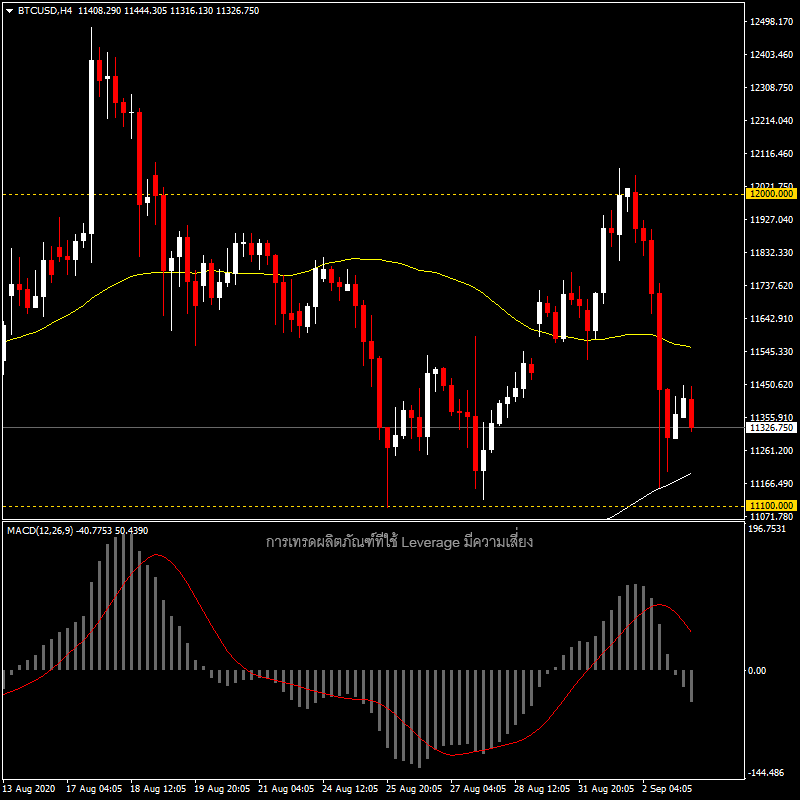

On the H4 timeframe, the price broke down and is now stuck between the 50-period MA and 200-period MA, with MACD crossing below the signal line and into the negative area since yesterday. But the signal line is still in the positive region. If the price breaks the 200-period MA, it could suggest depreciation of the asset along with the head and shoulder pattern seen on the Daily timeframe.

For the price to break through the key Support and Resistance, it may require a higher momentum. We could to see this momentum from the rest of this week’s major events from the US side, starting with today’s weekly unemployment numbers and the non-industrial ISM-PMI index, and continuing tomorrow with the main event for the first Friday of every month, the Non-Farm employment figures and other labor sector figures.

Click here to access the Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.