FX News

European Outlook: Asian stock markets headed south after a mixed closed on Wall Street. “Trump anxiety” is blamed for falling risk appetite, while a stronger Yen weighed on Japanese exporters. Chinese stocks trading in Hong Kong as railway and construction companies were under pressure following an infrastructure summit. U.K. and U.S. stock futures are also under pressure, pointing to a correction in the FTSE 100, which outperformed yesterday with a 0.91% gain and a close above 7500. The DAX moved sideways at high levels amid bouts of profit taking but managed to close above 12800. Gilt futures recovered losses as safe haven demand picked up again and Bund futures, which closed marginally in the red moved higher in after hour trade, which against the pressure on stock markets points to early gains and a dip in yields. The European calendar has U.K. labour market data and the final reading of Eurozone inflation numbers for April.

FX Update: The dollar is trading softer against most currencies, particularly the yen with USDJPY dropping quite sharply, from levels above 113.50 yesterday to a 12-day low today in Tokyo at 112.34. The narrow USD index has fallen for fourth consecutive session, making its lowest levels since last November’s presidential election. EURUSD rose to a fresh six-month high of 1.1116. Concerns about the about the pro-Trump growth agenda have weighed on the dollar. First the Senate Majority Leader McConnell appeared to downplay aspects of the plans for revenue-neutral tax cuts, Dodd-Frank rollback, among other things, and later news erupted about an alleged existence of a potentially Trump-damaging memo written by ex-FBI director Comey. This rattled Wall Street and led to a mostly negative session across equity bourses in Asia, which in turn let to yen outperformance as market participants sought safe havens.

U.S. reports: revealed a robust industrial production report that left good news for the day on net, though we saw disappointing housing starts data with annual revisions that lowered the recent trajectory. For factories, we saw a 1.0% April industrial production surge with gains spread across the manufacturing, mining and utility components, and we expect a robust 6% headline growth clip in Q2 led by mining and utilities. For housing, we saw April drops of 2.6% for starts, 2.5% for permits, and 8.6% for completions.

UK April CPI came in perkier than expected in rising to a new cycle high of 2.7% y/y, the highest rate since 2013 and up from 2.3% y/y in March. The core CPI reading came at 2.4% y/y from 1.8% in the previous month. PPI input prices unwound some, dipping to 16.6% y/y from 17.4% y/y in March, itself downwardly revised from 17.9%. Cable has U-turned sharply lower, to a low so far of 1.2865, following a short-lived rally to 1.2958 seen at the prompt of a perkier than expected UK CPI. German ZEW investor confidence rose to 20.6, slightly below expectations, but still up from 19.5 in the previous month. Eurozone Q1 GDP growth was confirmed at 0.5% q/q, in line with the preliminary number and unchanged from Q4 last year. The outcome of the French Presidential election continues to underpin an improved assessment of global political risks, while a fresh rise in German ZEW investor confidence underpinned hopes of stronger growth ahead, even as Eurozone Q1 GDP numbers show a still uneven recovery. The fact that the ECB has signaled a very gradual move towards policy normalization meanwhile is helping to keep Eurozone spreads in. In the U.K. April inflation data came in higher than expected, but still fitted the BoE’s inflation outlook.

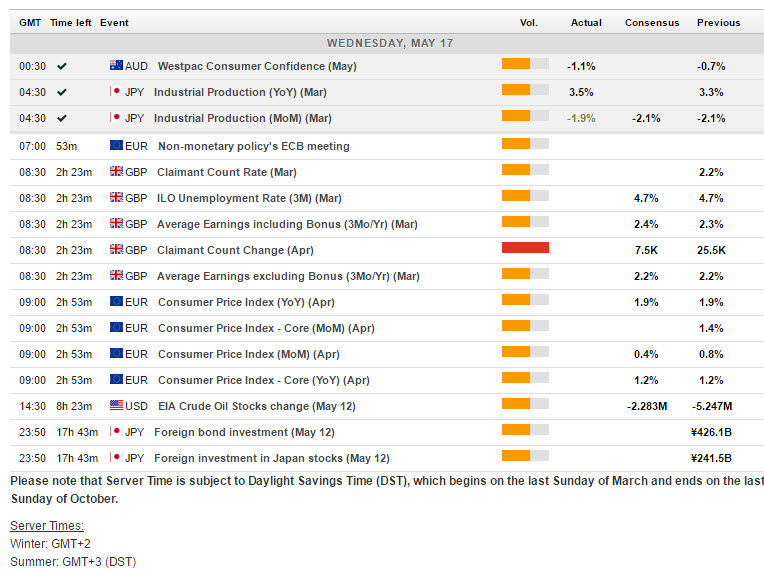

Main Macro Events Today

- U.K. Labour Data – March ILO unemployment rate anticipated to remain unchanged at 4.7%. In-line data shouldn’t have too much impact on sterling. The Claimant Count Change expected to fall 7.5K from 25.5K last month.

- EMU Final April HICP – The final April EMU HICP should confirm the headline rate at 1.9% y/y and core at 1.2% y/y. The pronounced up and down over the March/April period was impacted by the later timing of Easter.

- EIA Inventories – EIA Crude Oil Stock Change is on tap as well and an improvement is expected at -2.283M from -5.247M last week.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/17 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.