FX News

European Outlook: Global stock markets continue to eye record highs, S&P 500,, Nasdaq, DAX, FTSE 100, Korea’s Kospi and Tawain’s Tatex as well as the MSCI World Index all reached record highs this week and Japan’s Topix is also higher on the day and eyeing the 20000 mark. The DAX, which managed to close above 12800 could open slightly down, while FTSE 100 futures are moving higher, while U.S. futures are moving sideways. The move higher is slowed by bouts of profit taking, but France’s election result and confidence that central banks will continue to keep an eye on markets and step in if necessary seems to be underpinning global stock market confidence for now. Against that background core yields are moving higher and for now at least improved sentiment is keeping Eurozone spreads narrow, even if the ECB is heading for a change in the forward guidance. German ZEW investor confidence today is expected to have improved again and the calendar also includes inflation data from the U.K. as well as the second reading of Eurozone Q1 GDP and.

FX Update: The euro has continued to drift upward, with EURUSD logging a nine-day high at 1.0987 just ahead of the London interbank open and EURJPY clocking a fresh one-year peak just shy of the 125.00 level. A combo of a risk-on backdrop and a sizable reduction in existential political risks in the Eurozone, post French election, now that last week’s “on-the-fact” profit taking phase has come and gone, have been both weighing on the yen and underpinning the euro. Last week’s sub-forecast U.S inflation data has also been in the mix, denting appetite for long dollar positions. EURGBP is trading in three-week high terrain, while Cable has nestled slightly above 1.2900. with the market looking to be lacking the impetus for a challenge of last week’s seven-month peak at 1.2990. USDCAD has remained heavy following the strong rally in oil prices yesterday. The pair is presently in the low 1.36s, just above yesterday’s 18-day low at 1.3601.

U.S. reports: The Empire State headline fell to a 7-month low of -1.0 from 5.2 in April, 16.4 in March, and a 29-month high of 18.7 in February. The ISM-adjusted Empire State fell to a 4-month low of 52.2 from a 6-year high of 55.2 in both March and April, and 54.5 in February. The May headline drop reflected declines in every component, after big April drops for orders and the workweek, as the sentiment indexes continue to give back some of their early-2017 premium, as also underway with consumer confidence and small business optimism. Strength has been contained to the goods sector given restraint in payrolls, retail sales and GDP as the economy faces a weak global economy, a strong dollar, and a pattern of seasonal Q1 weakness.

France’s Macron picks centre-right Prime Minister. The newly inaugurated French President Macron picked Republican Party’s Edouard Philippe as his Prime Minister in a move that looks like an attempt to broaden his base ahead of the legislative elections in June. Philippe has been the mayor of Le Havre since 2010 and the two will need a majority or at least enough seats in parliament to form a coalition to push through his reform agenda. The economy is looking in better shape than a long time, but the reform backlog means unemployment remains high and France is also struggling to cope with a deficit that continues to exceed the 3% limit.

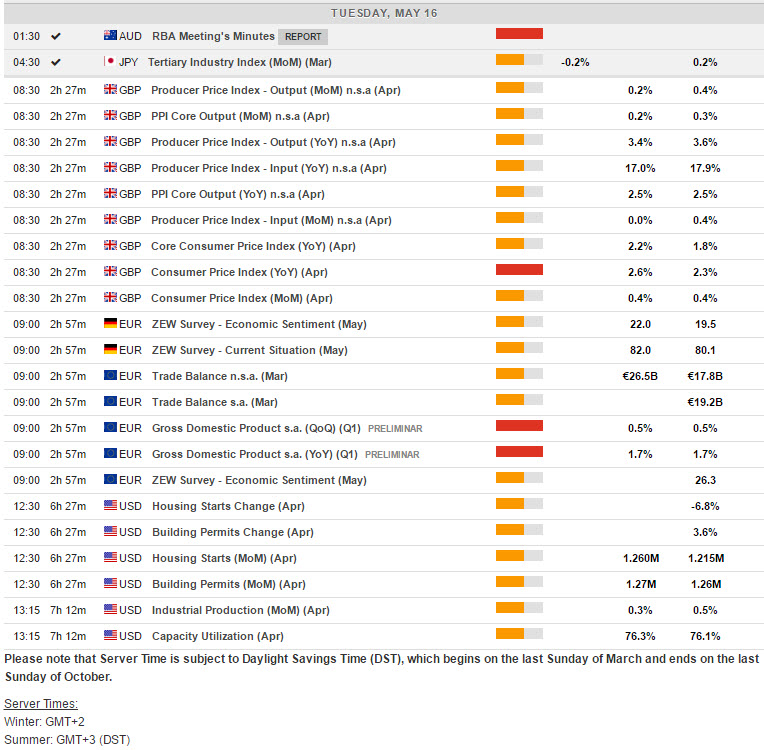

Main Macro Events Today

- German ZEW – Improvement in German ZEW Investor confidence is expected today to 21.0 in May from 19.5 in April – reflecting reduced political uncertainty, improving growth and rising stock markets. Forward looking indicators continue to underpin expectations for a broadening and strengthening of the recovery.

- UK Inflation Data – CPI expected to spike to a new cycle high of 2.6% y/y from the 2.3% print seen in the month prior. The 15%-odd y/y decline in sterling and the approximate 10% gain in the y/y oil price comparison underpins this forecast.

- EU GDP – Eurozone Q1 GDP is expected to be confirmed at 0.5% q/q and 1.7% y/y, in line with the preliminary number.

- US Housing Starts & industrial production – Housing starts should increase to a 1,260k pace in April from 1,215 in March, though risk is downward as construction employment slips in May. Industrial production is expected to rise 0.4% in April.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/16 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.