XAUUSD ,Daily

On May 4th I wrote “……XAUEUR rallied to an month low today at 1128.78, in the wake of the data, with weakness coming since April 13th, on the back of eased political concerns in France, with North Korea geopolitical risks, while the move lower was attributed also to the U.S. congress agreeing to fund the government through September, averting a potential shutdown. XAUEUR broke earlier Medial line of Andrews’ Pitchfork indicator applied since 13th of March, while the pair seems extending the Lower Bollinger Bands patterns. Hence an entry was taken at 1129.54. Support was set at 1134.00. Target 1 is at 1127.00 and Target 2 at 1123.00. “- The targets were hit post French Election Risk On mood as XAUEUR move $17.74 from Entry level on May 4th down to $1111.80 on May 5th.

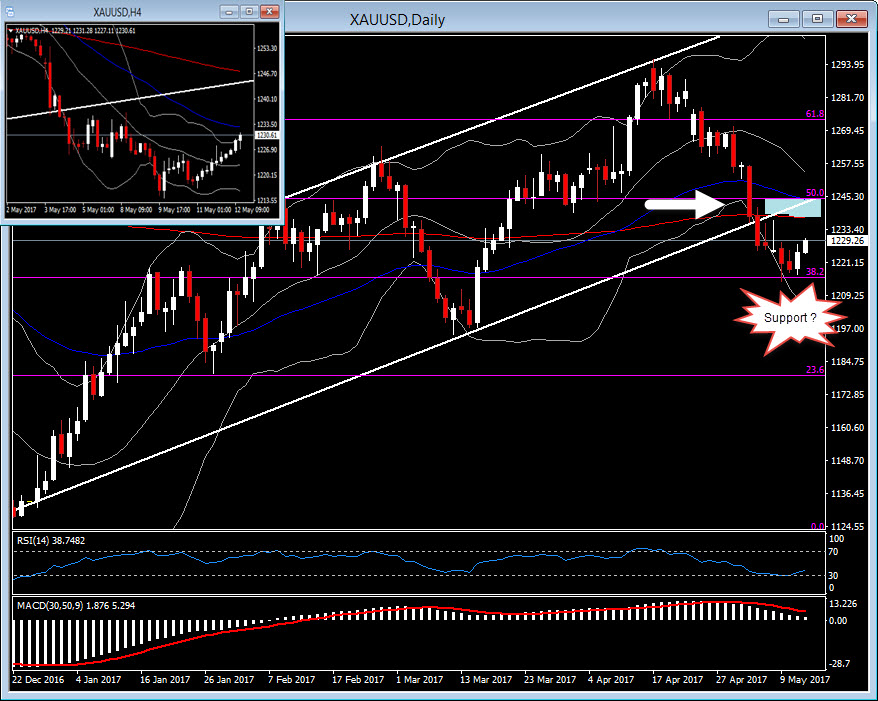

Gold followed the same downwards performance against US Dollar as well since April 17. Today though, XAUUSD rallied to four-session highs of $1,231.05 following the U.S. data mix, where retail sales were softer and core CPI cooler than forecasts. CPI rose 0.2% in April, with the core up 0.1%, not as hot as feared after yesterday’s PPI. April retail sales rose 0.4%, while sales excluding autos up 0.3%, little below forecasts. The -0.3% print on March headline sales was revised up to a 0.1% gain, and the 0.2% increase on ex-auto sales was bumped up to 0.3%.

In general, XAUUSD seemed more stable this week since it holds above $1,214.00, which is also a confluence of 38.2 Fibonacci Level, since Tuesday. Technically, XAUUSD in the 4-hour and Daily chart as well, satisfies quite well a year’s uptrend Channel, while many indicators seem positive on a possible reversal of the down trend since April 17. In the Daily chart, MACD remains positive, while RSI is 39 pointing up.

Therefore, I believe that a break above $1,236.00 – $1,245.00 area, which actually is the area between the significant 200 Day EMA and 50 Day EMA (also 50.0 Fibonacci), will suggest a bullish momentum for XAUUSD. In this case, it is possible to see XAUUSD getting back in Channel and to reach higher prices.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/16 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.