GBPAUD, Daily

The dollar has been trading firmly so far today. USDJPY edged out a fresh two-month peak at 113.39. EURUSD picked up bids into 1.0900, fueling a rebound to the 1.0920 area and leaving a post-French election low at 1.0902, while AUDUSD fell by over 0.5% in making a fresh four-month low at 0.7335 following a weaker than expected Australian retail sales report for March, with sales tipping 0.1% m/m lower, thwarting the median forecast for a 0.3% m/m rise. Cable traded modestly softer, to sub-1.2950 levels after yesterday logging a seven-month peak at 1.2990.

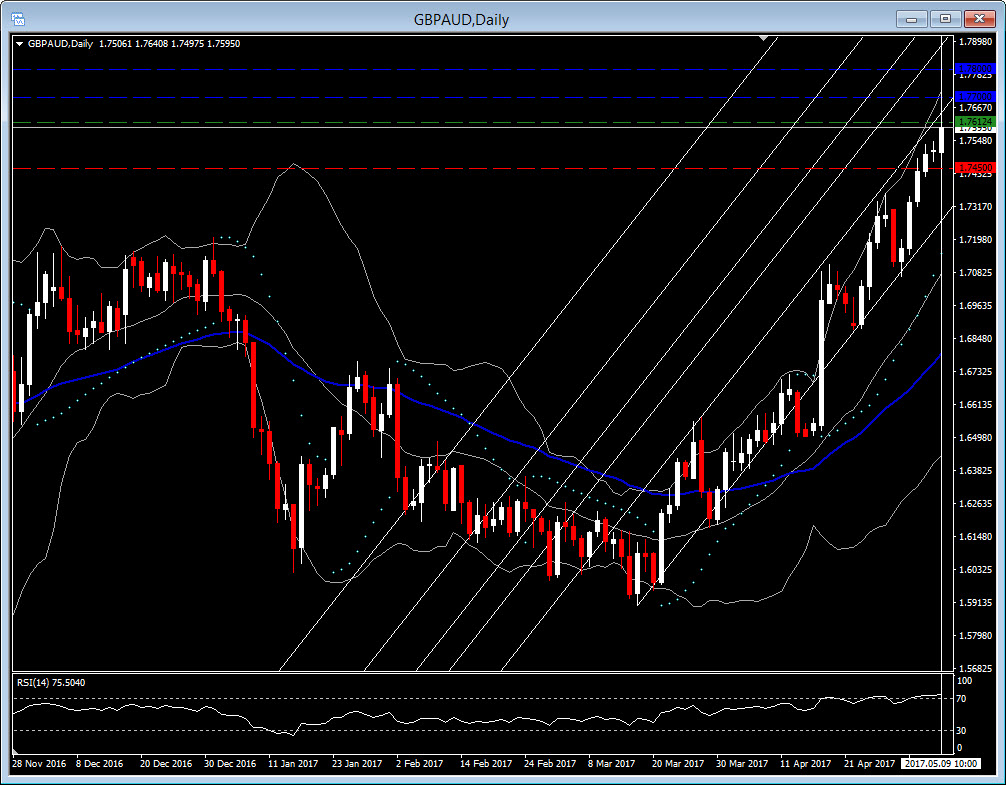

Weak retail sales data from Australia weighed on forex and equity markets and investors are taking stock while waiting for a catalyst before making further headway. Australian Dollar weakness due to this very poor Retail Sales, was highlighted in many pair crosses, such as with US Dollar and Sterling. Much of an interest for me was firstly GBPAUD, which is trading progressively higher since March 21st. Hence GBPAUD drifted above 1.7600 handle today following morning’s data.

The Daily chart suggests that GBPAUD will continue to be bullish, given the extension of Upper Bollinger Bands. Meanwhile in the 4-hour chart pair broke earlier the upper Bollinger bands making a new high at 1.7640. The RSI is at 75, however the upwards slope suggests that further upwards momentum is likely to continue. The MACD and Parabolic SAR remain positive since late March. In shorter timeframes such as hourly charts the pair seems to present a possible intraday correction of the trend, by going 30 pips down.

Hence Long position was taken in the daily chart, with entry at 1.7612. Support was set at 1.7450, which was a strong support area on Friday and Monday. Target 1 was set at 1.7700 with the help of trendline, while using ATR (14), Target 2 was set at 1.7800.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/10 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.