FX News

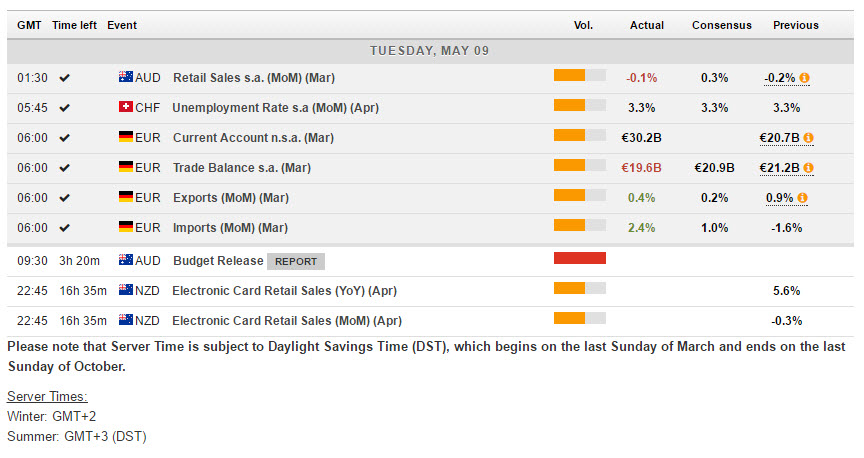

European Outlook: Asian stock markets outside of Hong Long slipped after yesterday’s rally, which saw Japan’s Topix rising to the highest level since December 2015. The Nikkei is little changed on the day and Chinese stocks fluctuated. Weak retail sales data from Australia weighed on forex and equity markets and investors are taking stock while waiting for a catalyst before making further headway. In Europe FTSE 100 futures are moving higher, despite a stronger Pound ahead of the BoE meeting and as PM May is heading for a convincing victory in the June election. The DAX may have risen above 12700 for the first time ever last Friday, but is struggling to keep that level amid bouts of profit taking as the Macron rally peters out and the focus turns to ECB tapering. Mersch yesterday all but confirmed that the ECB will change its forward guidance in June and tapering announcements are now being expected for September. With that in mind Eurozone spreads are likely to remain volatile, as markets try to assess what the withdrawal of the ECB’s support measures means for peripherals. Today’s calendar has Italian retail sales data. Already released U.K. BRC retail sales were much stronger than anticipated, but March/April are likely to have been impacted by the different timing of Easter this year.

Fedspeak: Fed’s Mester discussed yesterday the economic outlook before the Chicago Council of Global Affairs. As she stated, she wants rate action taken before the Fed’s goals are met as she’s worried about falling behind the curve, according to her prepared remarks on the economic outlook. It’s important for the FOMC to remain “very vigilant against falling behind.” If price pressures become excessive as the labor market becomes unsustainably tight, policymakers may have to “move rates up steeply,” and that could risk recession. And she believes the Fed has achieved its maximum employment goal. She would also like the Fed to start normalizing its balance sheet this year. She is a hawk, but doesn’t vote this year. Fed’s Bullard on the other hand, believes the current rate setting is appropriate, according to a speech on the natural rate at an Atlanta Fed conference. He stated that the “natural rate of interest, and hence the appropriate policy rate, is low and unlikely to change very much over the forecast horizon.” And he added the U.S. seems to be in a low-growth state, though “a case could be made that some recent observations have been more consistent with the high-growth state.” Bullard is not a voter this year.

Germany: posted a sa trade surplus of 19.6 bln in March, down from EUR 21.2 bln in the previous month. Exports dropped 0.4% m/m , while imports surged 2.4% m/m, the latter after falling -1.6% m/m in February. March data brought the total for the first quarter of the year to EUR 59.7 bln, down from EUR 60.0 bln in the previous quarter. These are nominal numbers, that do not account for fluctuations in exchange rates and oil prices. And with import prices picking up that suggests real data will look somewhat better. Overall though net exports actually detracted from overall growth last year, and are still pretty subdued. The current account surplus widened in March, and rose 1.2% y/y in Q1, thus adding further ammunition to the critics of Germany’s large surplus.

Main Macro Events Today

- US NFIB & JOLTS – Today, the April NFIB Small Business Optimism Index is out, which has improved significantly since the Trump election. Also, we will see JOLTS job openings for March will give the markets another angle on the labor market.

- Canadian Building Permit – Building permit values are projected to expand 5.0% m/m in March after the 2.5% drop in February. Looking back, the 2.5% decline in building permit values in February came after a revised 5.8% gain in January (was +5.4%).

- Fedspeak – St Louis Fed’s Bullard will be on a panel discussing interest rates today. The dove Kashkari will speak at a high-tech conference. Rosengren speaks at an NYU conference on risk management. Kaplan will speak at an interest rate summit.

- AU Budget Report – Australia’s calendar has Annual Budget Release today.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/09 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.