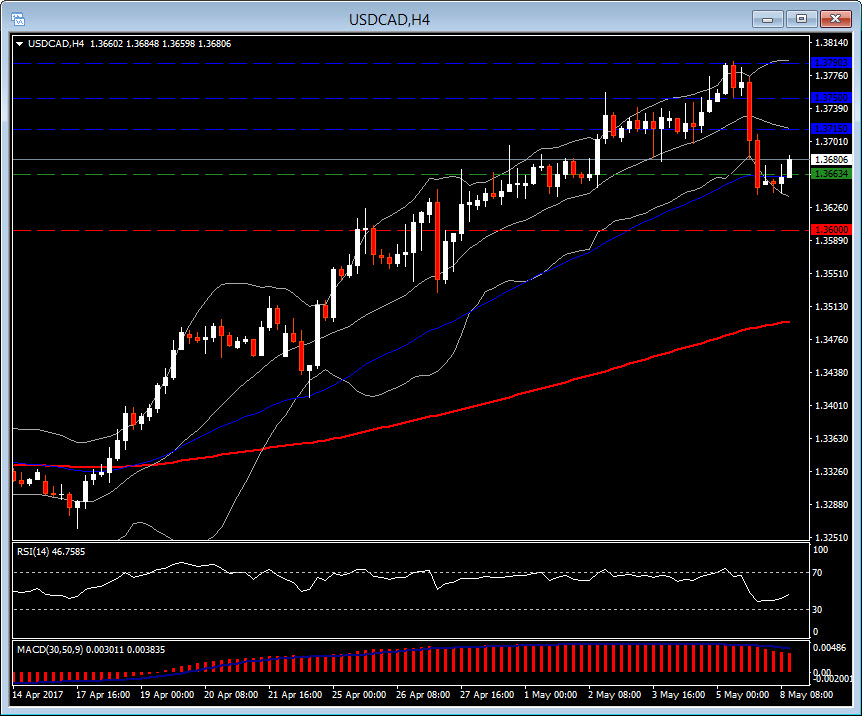

USDCAD, H4 & Daily

Equities rallied as oil prices rebounded after plunging to six month lows overnight. Front-month WTI crude prices are trading at near flat levels on the day, at $46.28, with the market now in a consolidative mood after lifting out of the six-month that was pegged last Thursday at $43.76. The move came after Thursday’s oil price pull-back and equity market decline. The narrative between booming U.S. production and OPEC-led supply trimmings continues to persist. The market is discounting that OPEC and its non-member oil producing allies will agree at a meeting on May 25 to extend the prevailing crude output curtailment for another six months, which would take it through to the end of the year. A jump in U.S. supply, meanwhile, is coming onto the market, though persisting price levels below $50.0 may deter some producers in costly shale extraction. Crude prices are presently down by 5.4% over the last week, and off by 11.9% m/m.

The Loonie also reversed course, charging higher against the U.S. dollar on the bounce in crude oil prices. However, this was temporary, since with Market opening today, USDCAD manage to stay above Friday’s closed at 1.3650. Today, a support above 1.3640, has been noticed for 4 consecutive sessions, in the 4 – hour chart, which was also a confluence area of the Lower Bollinger Bands. Hence this prompted today a Long position in the 4-hour chart, by considering also the fact that pair is in an uptrend since April 13th. Entry was taken at 1.3663.

Additionally, USDCAD broke earlier the 50-period EMA, crossed upwards the lower Bollinger Bands. The RSI is at 48 sloping up, while MACD remains positive. An intraday Target was set at 1.3715, which is also the confluence of 20-period EMA, in 4-hour chart. Meanwhile in the daily chart based on 14-days ATR, daily targets where set at 1.3750 and 1.3790. Support was set at 1.3600.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/09 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.