FX News

European Outlook: Asian stock markets headed south as oil dropped below USD 45 per barrel for the first time since November last year. Chinese equities meanwhile continued to decline amid ongoing efforts by regulators to curb leverage and speculation. Japan and South Korea remained closed for holiday and investors are looking ahead to today’s U.S. jobs report. With a pretty empty data calendar in Europe, the latter will remain in focus and it remains to be seen whether Eurozone markets, which already “celebrated” Macron’s clear lead in the polls ahead of Sunday’s presidential election yesterday, can push things further today, or whether caution returns, especially ahead of the U.S. numbers. Bund futures, which sold off sharply yesterday, moved sideways in after hour trade and FTSE 100 and U.S. stock futures are heading south and after the DAX reached new all time highs yesterday there may be some profit taking.

U.S. reports: revealed a better than expected round of March trade figures but downside surprises for the nondurable data in the March factory goods report that trimmed our Q1 GDP estimate back to the 0.7% advance figure despite firm equipment readings, with an $8 bln downward inventory revision that offsets an expected $8 bln construction boost. We also saw a tight round of initial claims figures at the close of April that added to the upside risk for 185k April nonfarm payroll estimate in tomorrow’s jobs report. The Q1 productivity figures revealed the expected 0.6% Q1 drop after a Q4 boost to 1.8% from 1.3%, while the weekly Bloomberg consumer comfort index rose to a 50.9 figure that sits just below the 51.3 cycle-high from mid-March. All the data support the narrative that the Q1 growth figures were depressed by seasonal weakness that will be sharply reversed in Q2 and Q3.

U.S. House “narrowly passed” the healthcare reform bill that aims to replace ACA with a new program, though the final shape of the package will be determined by the Senate, which just signed off on the temporary government funding bill through September. U.S. Senate has passed the $1.1 tln spending bill to fund the government through the rest of the fiscal year. The vote was 79-18. It has been passed on to the president for his signature which will finalize the legislation (the current CR expires Friday). He sign it, even though it doesn’t include many of his campaign priorities, including funding the border wall. It also doesn’t include the proposed $18 bln in spending cuts for healthcare, the environment, and other programs. But, it provides some $21 bln of the requested $30 bln in additional military funding.

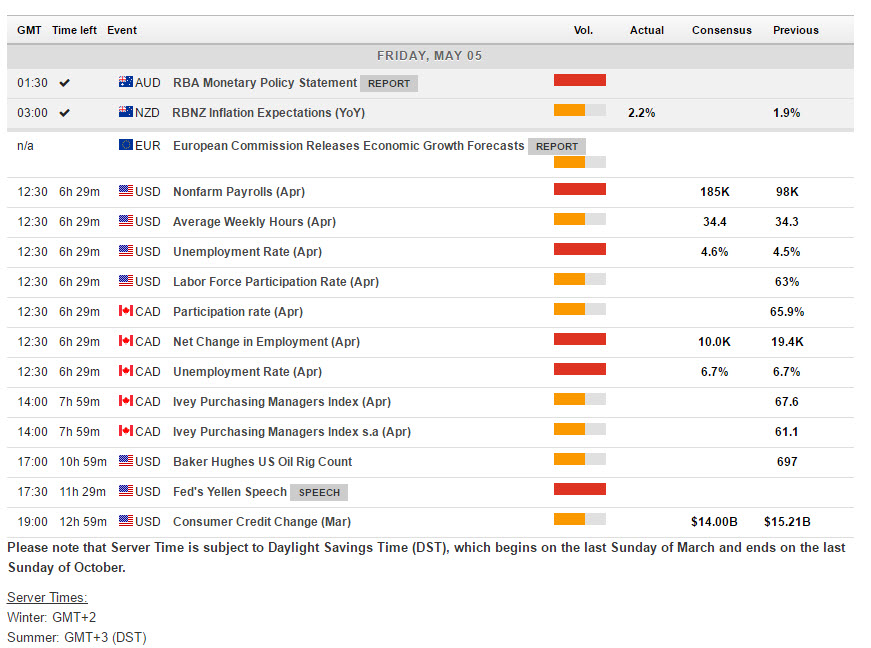

Main Macro Events Today

- US Employment – April employment data is out today and expected at 185k headline that exceeds the 98k headline and March but falls short of February’s 219k bounce.

- Canada Employment – Employment is expected to rise 20.0k in April after the 19.4k gain in March. The risk remains for a pull-back in jobs given the robust gains in total jobs that stretch back to August with only one interruption. The Ivey PMI for April is due today as well.

- Fedspeak – Fedspeak resumes today with speeches from Chair Yellen, her Vice Chair Fischer and SF Fed’s Williams. Chicago’s Evans, Boston’s Rosengren and St. Louis’ Bullard will take part in a panel discussion. Yellen is slated to speak on “125 Years of Women’s Participation in the Economy” at 13:30 ET.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/09 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.