FX News

European Outlook: Bund futures headed south in after hour trade yesterday and yields spiked in the wake of the FOMC announcement, which saw the Fed reiterating plans for gradual rate hikes. Asian stock markets were mostly down, the CSI managed to hang on to marginal gains however, and Japan remained closed for this week’s holidays. Metals dragged markets down as iron ore futures tumbled amid inventory concerns. U.S. and U.K. stock futures are moving higher though, pointing to opening gains, while the drop-in Bund futures late yesterday suggests opening losses on bond markets. Today’s calendar has services PMIs from the Eurozone and the U.K. as well as the Norges Bank decision. The U.K. also has lending data and the Eurozone retail sales numbers for March.

U.S. reports: revealed a solid round of April ISM-NMI figures that highlighted the upside risk for our 190k April payroll estimate, though we also saw a restrained round of April ADP figures after an outsized March gain. For sentiment, a 57.5 April reading sat just below the 16-month high of 57.6 in February, versus an interim 55.2 figure in March, while the ISM-adjusted measure similarly returned to the 18-month high of 56.5 from February, versus an interim 53.9 figure in March. For ADP, a 177k April rise slightly above expectations, though the March ADP surge was only modestly trimmed to 255k from 263k, leaving substantial room for “catch up” in Friday’s jobs data. The March payroll data may have been depressed by bad weather in the BLS survey week, and ADP figures aren’t impacted by weather disruptions as inactive workers generally remain on company’s payrolls, so the big net-rise for ADP over the March-April period suggests upside risk on Friday.

FOMC left policy unchanged with a 0.75% to 1.00% target band. The Fed’s statement acknowledged the slowing in Q1 growth but said it was “likely to be transitory.” There was no new information on the balance sheet. For more of the guts of the statement, the Fed added that the labor market continue to strengthen, even as the economy slowed. Household spending rose only modestly but the fundamentals underpinning the continued growth of consumption remained solid. Business fixed investment firmed. Meanwhile, annual inflation has been “running close to the Committee’s 2% longer-run objective,” said the Fed, which was a small but important shift from March where the Fed said “inflation was “moving close to the…2% target.” It looks like price pressures are even nearer the goal. Near term risks to the economic outlook remain in balance. The vote was a unanimous 9-0. The outcome is as was expected. The door was left wide open for a tightening in June if the data tracks the expected Q2 rebound.

Europe: EMU Q1 GDP growth came in at 0.5% q/q, while the annual rate fell back to 1.7% y/y from 1.8% y/y. There was no breakdown with the preliminary release but in any case, it is likely that the different timing of Easter this year has led to some distortions, as the services sector will have gotten a boost in April this year, rather than in March, while production will have been stronger without the holiday period in March this year compared to 2016. Hence it is widely expected to see the ECB removing its easing bias at the June meeting, when the updated set of staff forecasts are also due. The UK April construction PMI beat expectations in rising to a headline reading of 53.1. Residential construction and civil engineering activity drove the uptick in expansion in the sector. Both construction and the manufacturing PMI’s have beaten expectations, rebounding from a recent soft patch and showing once again that the UK economy is performing resiliently as the sharp end of the Brexit process draws closer. Attention will now fall on the services PMI release today, as this sector accounts for nearly 80% of the economy.

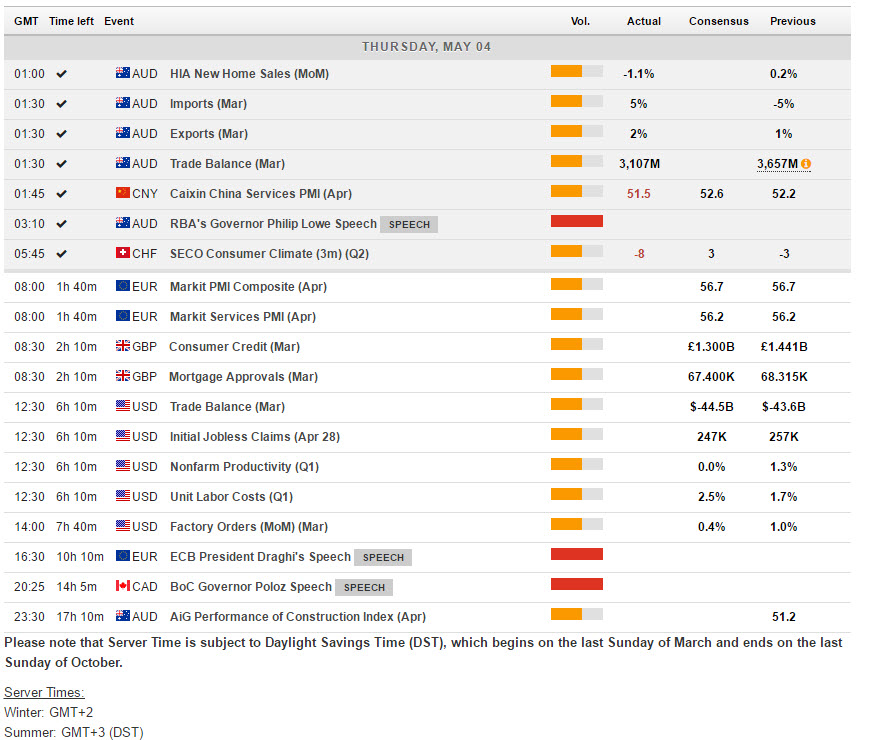

Main Macro Events Today

- US Data – The March trade deficit is set to widen to -$44.5 bln from -$43.6 bln and Q1 productivity is seen flat down from 1.3% in Q4. Initial jobless claims may dip 10k to 247k for the week ended April 29, while March factory goods are expected to be at 0.4% vs 1.0%.

- Canadian Trade balance and BoC Governor Speech – The March trade report is projected to show a trimming in the deficit to -C$0.8 bln from the -C$1.0 shortfall in February that ended the upbeat run of trade surpluses that lasted from November of 2016 to January of this year. Also, BoC Governor Poloz delivers a speech in Mexico City to the CanCham Mexico and Club de industrials.

- ECB’s Draghi Speech – There is plenty of ECB speak from Lautenschlaeger, Praet and Draghi among others, but comments are likely to focus on Draghi’s main message from last Thursday, namely that nothing has changed so far.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/04 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.