FX News

European Outlook: Asian markets were thinned out by holidays with Japan, South Korea and Hong Kong closed, CSI and ASX are in negative territory ahead of the Fed announcement. Poor Apple Inc earnings results weighed on sentiment but this didn’t prevent Taiwan markets to move slightly higher. No surprises are expected from the FOMC — not any change in rates nor any clear hint of the timing of the next move, but surveys suggest another rate hike in June. There’s no press conference or release of estimates this time around, thus the only update on Fed thinking will be via the policy statement, and that shouldn’t be too revealing. U.K. and U.S. stock futures are also down, pointing to a correction in European markets, which managed to extend gains into the close on Tuesday. The DAX cleared the 12500 mark yesterday and was at new all-time highs. The European calendar has German unemployment data for April as well as the first reading of Eurozone Q1 GDP, a German 10-year Bund sale and the U.K. Construction PMI for April.

FX Update: The dollar majors have been plying narrow ranges into the Fed’s policy announcement later today, where Bloomberg calculates there is a 12.8% chance for a 25 bp rate hike. EURUSD eked out a three-session peak at 1.0936, and is presently settled near net unchanged on the day at 1.0921 bid. USDJPY has settled to an orbit of the 112.00 level, below the one-month peak seen yesterday at 112.30. Sterling has come under pressure heading into the London open, with Cable have shed over 50 pips in making a 1.2884 low. This follows yesterday’s failure to test last week’s six-month high in the wake of a strong UK manufacturing report, and with all the signs suggesting that the Britain and the EU are heading into tough Brexit negotiations. Market conditions have been thin so far today, with Japan and Hong Kong out.

U.S. ACA repeal update: “very good progress” is being made on Obamacare repeal, said House Speaker Ryan, following remarks from Majority Whip Scalise that the modified healthcare plan would still protect those with pre-existing conditions. A vote on the bi-partisan intermediate government funding bill is scheduled for tomorrow, while a vote on ACA repeal has yet to be set. Meanwhile stocks and yields are heading lower after soft initial auto sales figures for April.

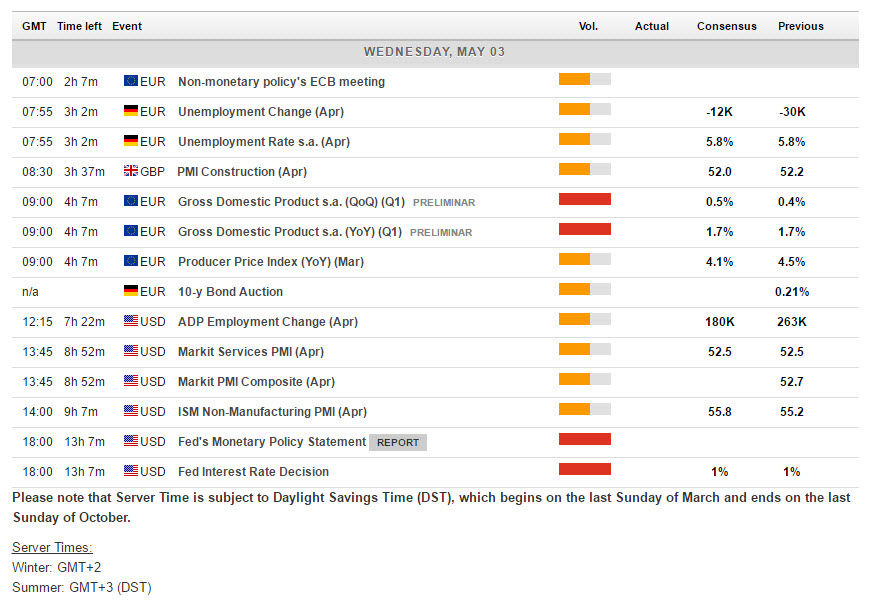

Main Macro Events Today

- EU GDP – Eurozone GDP growth of 0.5% q/q, from 0.4% of Q4. In the past, variations in the timing of Easter have had an impact on quarterly growth rates and maybe it’s better to see Q1 and Q2 in conjunction to better assess the underlying trend.

- US ADP Employment & ISM Services – The April ADP Employment report should post a 180k gain, below the March figure of 263k. April ISM services may bounce to 55.8 from 55.2, while EIA energy inventory data is due.

- FOMC Statement – FOMC began its meeting and will announce its decision today. No change is widely expected. There’s no press conference this time around, or release of economic and dot-plot forecasts, so the statement will be scrutinized for hints on the normalization path.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/03 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.