GBPAUD, H1

The business week in London markets starts on Tuesday after the May Day holiday on Monday. The pound has continued to gain following British PM May’s April-18 call for a general election, to be held on June 8. Cable clocked a six-month peak at 1.2965 and closed out on Friday at its highest weekly closing level since the last week of September. Incoming polls have been confirming that the governing Conservative Party is on course to win a sizable majority at the June 8 election, giving the pound a lift on the view that this will give PM May a clear Brexit mandate and greater flexibility in upcoming negotiations. There is a sense that whatever economic Brexit reckoning is yet to come, it is still some way down the road, with the negotiations not likely to start in earnest until after the German elections in September.

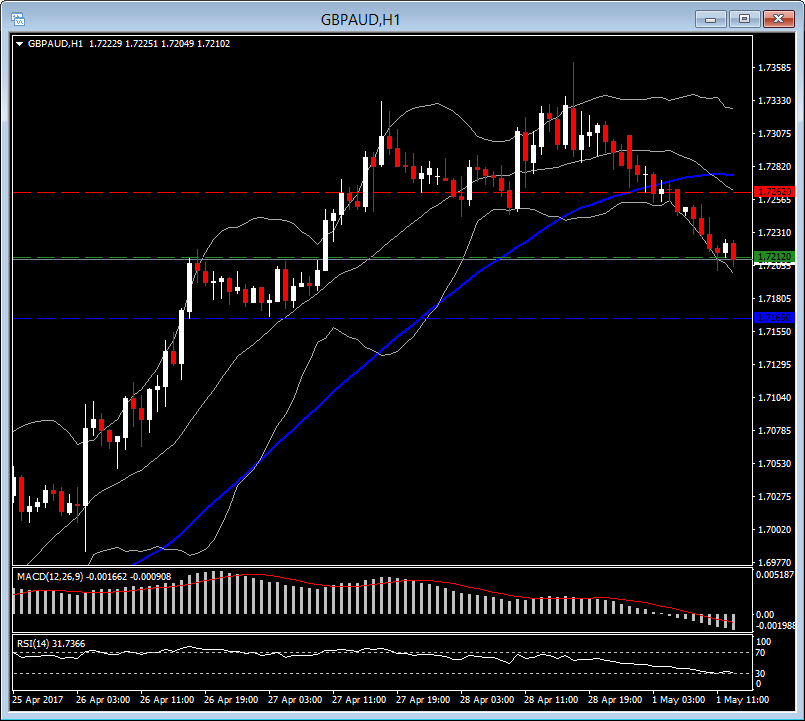

Similar behaviour like Cable, was noticed for GBPAUD, which clocked 7 months high on Friday at 1.7362. However, the pair today prompted a SHORT position in the 4-hour chart after marking 4 consecutive down candles, and breaking also the 20-period EMA. Also in 1-hour chart, the 20-period EMA, crossed downwards the 50-period SMA in morning. The RSI is at 33, while MACD turned negative since earlier today.

Hence GBPAUD drifted it back today to 1.72 area. Entry was taken at 1.7212, while by considering ATR (14) in the 4-hour chart, target for today was set at 1.7165. Support was set at 1.7262.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/02 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.