FX News

European Outlook: Asian stock markets are narrowly mixed, with Japan’s stock rally running out of steam and Chinese equities underperforming as Xi stressed that financial security is “strategically important” to the country’s economic and social development, thus adding to signs that the government is stepping up its crackdown on leverage. The BoJ presented an upbeat picture of the economy, but left policy unchanged, giving markets little reason to move as investors digest Trump’s tax plan that was released yesterday. The Nikkei is down -0.19%, CSI 300 down -0.55%, while Hang Seng and ASX manage marginal gains. FTSE 100 futures are down, while U.S. futures are moving higher. In Europe, the focus shifts to the ECB meeting, with Draghi likely to follow the BoJ’s example and refrain from rocking the boat although the hawks will step up their pressure, especially as German and Spanish HICP rates today are set to accelerate, while ESI economic confidence is seen rising further. The calendar also has the U.K. CBI retailing survey. as well as Spanish unemployment and German consumer confidence at the start of the session.

Trump E.O. on NAFTA (North American Free Trade Agreement) withdrawal is being mulled according to a Politico.com article posted earlier: “The Trump administration is considering an executive order on withdrawing the U.S. from NAFTA, according to two White House officials. A draft order has been submitted for the final stages of review and could be unveiled late this week or early next week, the officials said. The effort, which still could change in the coming days as more officials weigh in, would indicate the administration’s intent to withdraw from the sweeping pact by triggering the timeline set forth in the deal.” Additionally, House Freedom Caucus endorses the revised ACA repeal plan, noting “while the revised version still does not fully repeal Obamacare, we are prepared to support it to keep our promise to the American people to lower health-care costs.” It was the very conservative Freedom Caucus that generally derailed President Trumps initial plan. So far this week equity markets have gotten bullish news from France, taxes, and now the ACA. Wall Street remains in the green, but gains are limited so far after the surges on Monday, Tuesday, although a close here on the S&P at 2,398 would be a new record high. This latest news should particularly benefit healthcare and insurance stocks.

U.S. NEC Director Cohn is introducing the Trump tax cuts with some historic comparisons, as rates and the system are stuck at 1986 levels even as other countries have gotten more competitive and gone to a territorial basis. He will hand over the podium to Treasury Secretary Mnuchin next. There will be 3 brackets, 10%, 25% and 35% (reduced from 7) and double standard deductions, repeal the death tax, tax relief for families with child and dependent care, married couples won’t pay tax on the first $24k in income. They will repeal the estate tax and the alternative minimum tax, with a 15% business tax rate. Home ownership and charitable deductions will be retained, but most other tax breaks will be eliminated.

Canada: Retail sales volume dip tracks a February GDP stall-out.The 0.1% decline in retail sales volumes followed a 1.4% surge in January and a 0.6% decline in December. A 0.4% decline in wholesale shipment volumes joined the 0.1% gain in manufacturing volumes. Housing starts improved 2.3% to a 214.3k unit pace in February, suggestive of another positive contribution from construction production. Mining, oil and gas production are on track to make a substantial negative contribution to February GDP. The lack of growth in February GDP should be followed by a resumption of activity in March GDP.

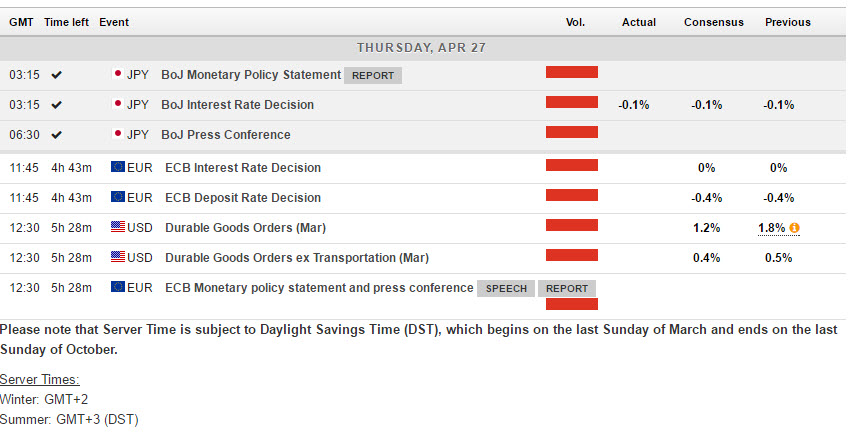

Main Macro Events Today

- ECB Confidence & Rate Decision – Confidence indicators continue to look good, inflation is expected to bounce back with the April reading and Macron’s advance in the French election means Frexit and Eurozone breakup risks seem banned for now. Against that background, the hawks at the ECB council will likely intensify their push for a change in the forward guidance at the council meeting tomorrow and Draghi will be under fresh pressure to at least drop the implicit easing bias.

- ECB meeting – ECB Monetary policy statement and press conference have been scheduled for 12:30 GMT today.

- US Durable Goods – March durable goods orders are expected to be unchanged (i.e. 1.2%) following February’s 1.7% increase, on top of the 2.3% January gain which were supported by transportation.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/04/27 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.