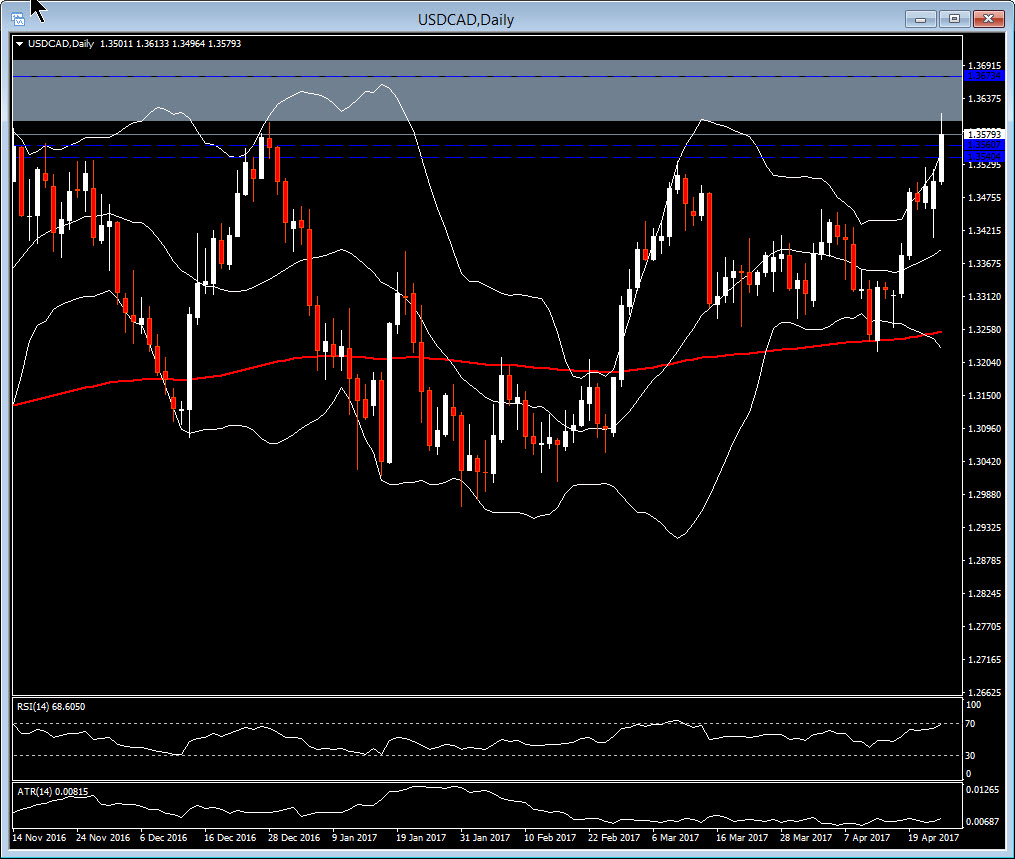

USDCAD, Daily & H1

WTI crude stayed under the $50 mark overnight, and is currently up 0.3% on the day, at $49.39. The modest gain today follows six consecutive sessions of decline, which left a four-week low at $49.03 yesterday. Prices are down by 5.8% week-on-week. Sentiment remains decidedly bearish, with the OPEC-led supply reduction, in place since the start of the year, and looking likely to be extended into the second half of the year, having failed to clear oversupply, with stockpiles at record levels. A surge of U.S. production is also set to hit the market in May.

USDCAD rallied to 14-month high territory of 1.3613, as the Loonie stays under pressure on the back of weak oil prices, and Monday’s threat from the U.S. to impose 20% tariffs on Canada’s soft-wood lumber exports. The U.S. has accused Canada of dumping lumber on the market at unfairly subsidized prices. Meanwhile,

Consequently, the pair drifted today to year’s high. Therefore, a possible closing today between the 1.3600 – 1.3650 key level (i.e. above December 28 peak), will indicate that bullish behavior is like to be continue in long-term. Above there, the pairing will be in 14-month high territory. Therefore, based on the daily ATR (14), if USDCAD’s strength continues, the next resistance level might be at 1.3670.

Meanwhile, in the 1 hour and 4-hour chart, pair presents an opposite performance, giving sings that in shorter timeframes the Loonie will get weaker. In the 1-hour chart, the last candle closed lower at 1.3598, with a big down wick up to 1.3581. RSI is overbought territory at 74, suggesting that there may be scope of a short-term decline within the day.

Hence, in a daily time frame the closing today will suggest whether a long or short position need to be taken. In an 4-hour timeframe, if further down candles printed for the next few hours, then a short position is likely to be taken with Target 1 at 1.3560, which is also a confluence of 23.6 Fibonacci level. Target 2 at 1.3540. In this scenario, support could be set at 1.3650.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/04/26 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.