US nonfarm payrolls increased 4,800k in June, better than expected, after the upwardly revised 2,699k (was 2,509k) bounce in May following the -20,787k (was -20,687k) collapse in April. The unemployment rate slide to 11.1% versus 13.3% (was 13.3%) previously, and April’s 14.7%. The rate was at a 50-year low of 3.5% in February. The labor force rose another 1,705k after the prior 1,746k gain, with household employment up 4,940k versus 3,839k. The labor force participation rate rose to 61.5% versus 60.8%. Average hourly earnings declined another -1.2% versus -1.0% previously, unwinding some of the 4.7% pop in April. Average weekly hours fell to 34.5 in June from 34.7 in May. Private payrolls climbed 4,767k (versus ADP’s 2,369k) following the 3,232k (was 3,094k) increase in May The goods producing sector added 504k, with construction up 158k. Service sector jobs increased 4,263k. And leisure/hospitality added 2,088k. While there are still a lot of warts in the economy and the data, this is still a good report that will help underpin optimism on the recovery.

U.S. trade deficit widened 9.7% to -$54.6 bln in May after widening to -$49.8 bln (was -$49.4 bln) in April. This is the second largest shortfall since October 2008, while the -$34.7 shortfall from February was a 5-year low. Exports dropped -4.4% after plunging -20.5% in April and -10.2% in March. Imports slipped -0.9% after dropping -13.6% in April (was -13.7%) and -5.6% in March. The “real” goods balance widened to -$86.5 bln from -$80.4 bln (was -$80.0 bln), with real exports declining -5.9% and real imports slipping -0.4%

Yields have only edged up moderately, especially considering the stronger than expected jobs report and the hefty bounce in stocks. Bonds are taking a rather circumspect view of the data, with underlying worries over the rise in the virus and the slowdown/retrenchment in reopenings. The 30-year is 4 bps cheaper at 1.462%, with the 10-year up 2.8 bps to 0.704%, while the 2-year is 0.4 bps higher at 0.164%. The curve steepened to 54 bps and is out from 47 bps to start the week. The front end continues to be contained by the Fed’s lower for longer policy. The belly of the curve is hanging in there with the 5-year up 1.3 bps at 0.324% even after the FOMC minutes should have discouraged yield curve control expectations.

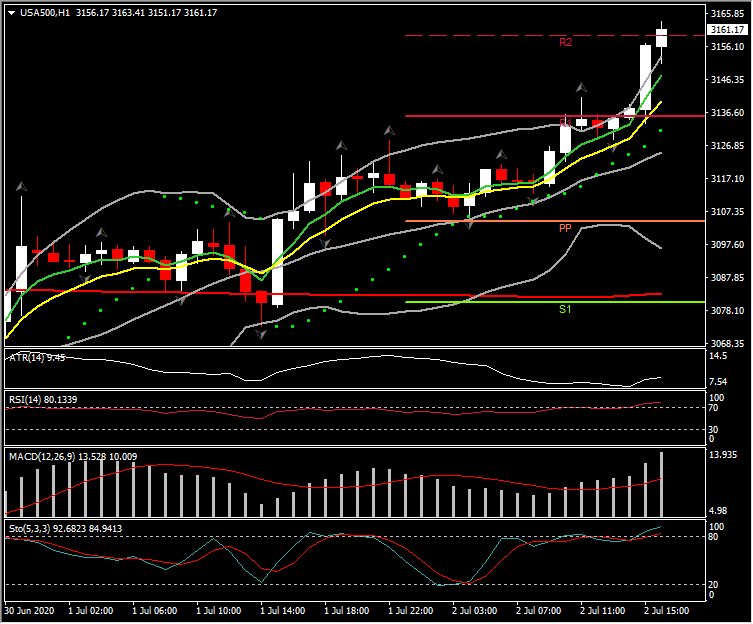

Meanwhile, US equity futures jumped on the headlines, extending early gains following the better than expected employment report. The USA30 is 1.7% higher, the USA500 is up 1.3% and the USA100 is 1.0% in the green. Hopes for a vaccine in the near term supported equities overnight, overshadowing the rising virus counts in some states that have prompted governors to pause the reopenings. In Europe, the Euro Stoxx has climbed 2.4%, GER30 is 2.4% higher and France’s CAC 40 is up 2.2%. The UK’s UK100 has improved 1.2%. Asia’s markets closed with gains, as Hong Kong’s Hang Sang jumped 2.9%, China’s CSI 300 rose 2.1% and Japan’s Nikkei 225 edged up 0.1%.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.