FX News

European Outlook: Key Asian stock markets moved higher despite the delay of Trump’s health care bill was delayed, which will now face an uncertain vote today. With the Dollar advancing and the Yen falling back the Nikkei managed a 0.9% gain, and the ASX closed up 0.8%, but the Hang Seng is in negative territory, The Shanghai composite is little changed and Taiwan’s index was down together with the Kopsi while Southeast Asian benchmarks were mixed. U.S. markets closed in the red yesterday, while European markets managed a late rally, and U.S. and U.K. stock futures are moving higher as investors await the final vote. In Europe, the calendar has preliminary Eurozone PMI readings for March, the U.K. has BBA mortgage approvals and EU leaders (minus U.K. PM May) will gather for a summit to celebrate the 60th anniversary of the Rome Treaties.

House delayed yesterday’s planned vote the healthcare bill, possibly until next week, according to news reports. Leadership has told members to be available today, however, in case a vote can be slated. Wall Street closed with modest losses, having unwound early gains as the prospects for the bills passage today dimmed through the day. The stock market is likely to remain in wait and see mode today, rather than stage a major selloff, given the possibility for a vote over the weekend or next week. Ways and Means Chairman Brady said (in CNBC interview) no one has walked away yet.

U.S. reports revealed solid February new home sales despite weakness in Wednesday’s existing home sales report, alongside a 15k pop in initial claims to an elevated 258k in the BLS survey week after annual revisions that mostly lifted levels of claims since November, leaving a net negative signal for the day’s data overall. For new home sales, a 592k rate beat estimates, though mild weather failed to lift sales above the 622k cycle-high rate in July of 2016.

UK February retail sales smashed expectations, rising 1.7% m/m and by 3.7%, up on the respective median forecasts for 0.4% and 2.6% growth. A rebound had been expected following two consecutive months of sub-par sales, though the magnitude was even greater than foreseen. January data were revised lower, however, to -0.5% m/m from -0.3% m/m initially reported, and to 1.0% y/y growth from 1.5% y/y. The ONS stats office advices caution, highlighting that the underlying three-month view shows sale in decline as a consequence of the weakness in December and January. After the strong retail sales report, out of the UK, cable has lifted back above 1.2500, with the pound finding support on dips. Additionally, BoE MPC’s Broadbent that UK exporters are benefiting from a temporary sweet spot, with the pound weaker following the Brexit vote but with trading terms remaining unchanged and with global growth picking up.

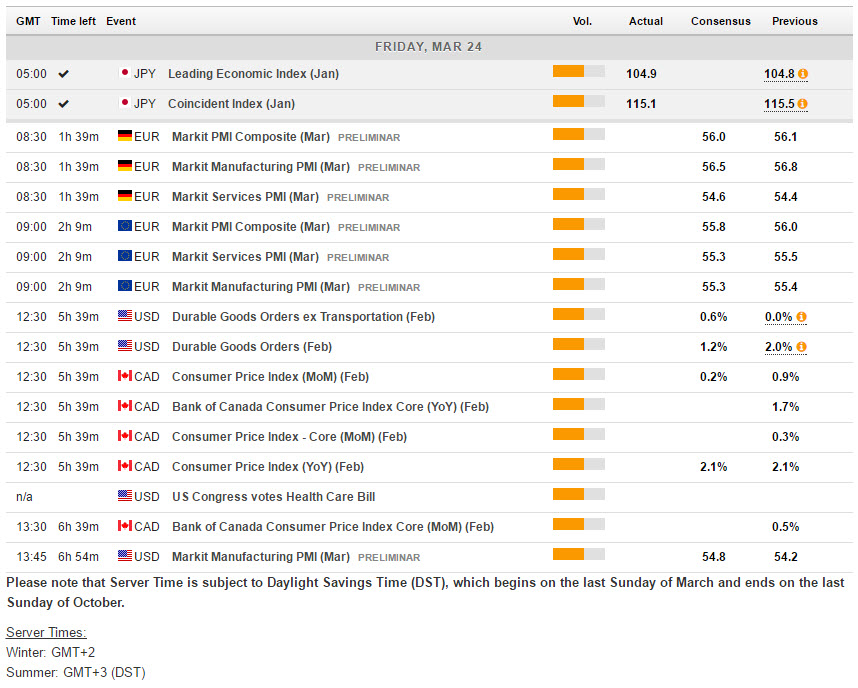

Main Macro Events Today

- Eurozone PMI – Eurozone Flash Manufacturing and Service PMI are out today and expected both to show a slight difference from February at 55.3 from 55.4 and 55.5 respectively.

- UK Durable Goods – February durable goods expected to see orders up 1.1% compared to respective January figures which had orders up 2.0%.

- Canadian CPI – The CPI is expected to rise 0.2% m/m in February after the 0.9% surge in January. On an annual comparable basis, CPI is stay unchanged to a 2.1%.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/28 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of