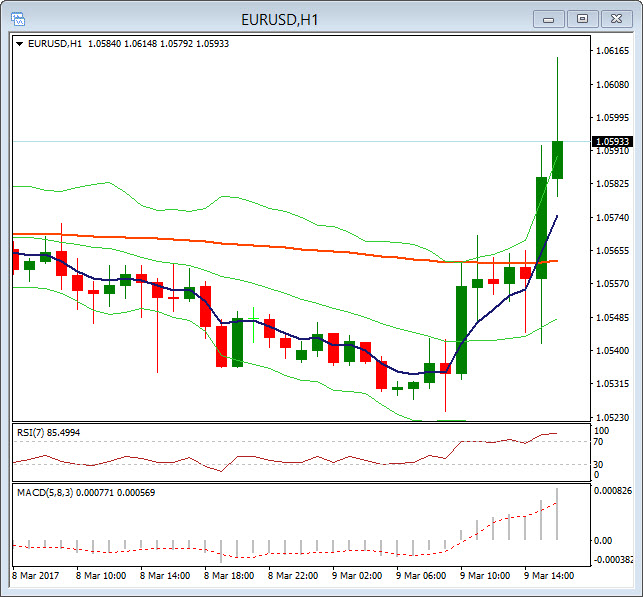

EURUSD, H1

The ECB lifted its inflation forecast for this year to 1.7% from 1.3% and to 1.6% from 1.5% for 2018. The forecast for 2019 was left unchanged at 1.7% and Draghi once again stressed that while inflation ticked up recently, this was mainly due to energy and food prices and that core inflation remained low and is only expected to pick up gradually going ahead. So effectively the ECB is sticking to the script and maintains its easing bias despite higher than expected growth and inflation indicators. The hawks at the council, which wanted the ECB to at least drop the reference to the possibility of another rate cut, have lost out, clearly also because there is considerable nervousness ahead of this year’s round of elections, after French yields in particular have been very volatile and highly sensitive to varying election polls. He did say in the press conference that ECB policy has been successful, a more neutral stance was likely, and there was “less urgency” as the statement about “all appropriate measures” had been removed. However, the easing bias remains in place.

The rally in the EUR during the press conference helped push my EURJPY long position from last week to target 2 at 121.80 for a net gain of 146 pips.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/14 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Senior Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.