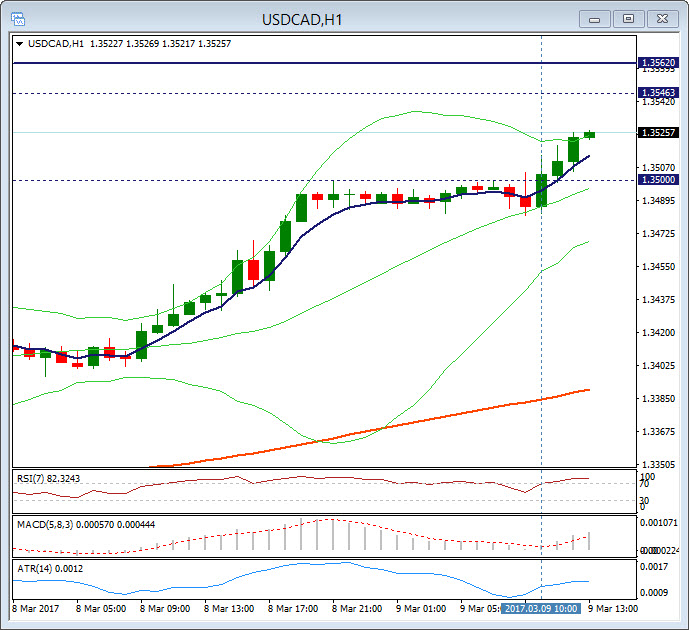

USDCAD, H1

USDCAD made a fresh high for the year at 1.3520 today, extending the breakout gains from the recent consolidation. Strong U.S. data, hawkish Fed speakers, Trump’s promise of a $1 tln infrastructure spend, along with the recent ebb in oil prices, have been underpinning the advance. USOil has broken below $50.00, the first time below this level since mid December, making a low at $48.80, a level last seen in late November. Crude is presently above the low at $49.22 bid, which is still a net decline of 2.2% on the day and a 7.7% loss on the week so far. The price action over the last day represents a downside break of the narrow range that had been persisting since early January, and there is a risk of further downside as futures data has been showing speculative accounts holding record long positions in recent weeks. The downside spark came yesterday, with data showing a further record high in U.S. crude inventories following bigger than expected stockpiling in the latest reporting week. Data this week also showed that Russia may be falling short of complying with its share of the OPEC-led move to trim supply.

The daily resistance on USDCAD and next target is 1.3562. On the intraday chart the 5 period EMA is supporting the pair in the H1 and H4 timeframes. Short term the H1 chart is showing signs of being overbought with the RSI at 81 and the price breaking the top of the Bollinger band , however further strength could be anticipated with a short term target of 1.3540-50 could be expected with the 5 period EMA as a trailing support area. The MACD remains positive

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/14 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Senior Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.