FX News

European Outlook: Asian stock markets are mostly higher, Japan underperformed and the Nikkei closed with a -0.18% loss with investors remaining cautious ahead of the Fed policy meeting and as markets price in a March rate hike. U.S. stock futures are narrowly mixed, FTSE 100 futures are moving higher, after European markets headed south yesterday and rising risk aversion saw Bund futures outperforming and Eurozone spreads widening. German manufacturing orders data at the start of the session are likely to continue to underpin Bund futures as the sharp rise in December is expected to be followed by a marked correction in January. The data calendar also has U.K. house price data from Halifax and detailed Q4 Eurozone GDP numbers.

US reports: The U.S. factory goods data undershot estimates thanks to a restrained 0.4% January nondurable rise for shipments and orders despite price gains, with a similarly lean 0.3% nondurable inventory rise after a big December boost. We saw only tiny tweaks in the durables data for orders, shipments, and equipment that still show a transportation-led orders gain with respectable equipment data, but with lean shipments and inventories. A boost in the Q1 GDP growth rate to 2.0% expected, from 1.9% with a $5 bln boost to factory inventories alongside a $2 bln hike for construction. More precisely, U.S. factory orders rose 1.2% in January after a 1.3% bounce in December and a 2.3% drop in November. The 1.8% jump in January durable orders was bumped up to 2.0%. Transportation orders rebounded 6.2% versus -4.3%. But excluding transportation, factory orders were unchanged from the prior 0.9% December gain. Nondefense capital goods orders excluding aircraft dipped 0.1% from 0.8% previously. Shipments rose 0.2% after the 2.5% surge in December. Nondefense capital goods shipments excluding aircraft slid 0.4% versus a prior 1.7% gain. Inventories edged up 0.2% from 0.3%. The inventory-shipment ratio was steady at 1.31.

Australia: Reserve Bank of Australia held rates steady at 1.50%, matching widespread expectations. The statement by Governor Lowe was cautiously constructive on the outlook for growth and inflation. The outlook continues to be supported by low levels of interest rates, Lowe said. On the exchange rate, he said the depreciation since 2013 has assisted the transition in the economy following the mining investment boom. An appreciating exchange rate, he noted, would complicate that adjustment. Overall, the statement is consistent with an extended period of steady, accommodative policy lasting into 2018.

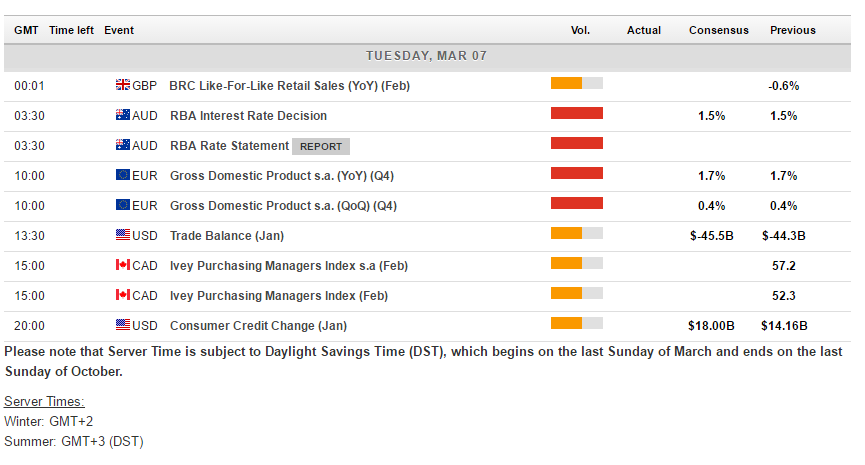

Main Macro Events Today

- US Trade Balance – January trade data is out today and expected the deficit to jump 10.7% to -$49.0 bln from -$44.3 bln in December. Exports expected to be down 0.2% on the month with imports up 1.9%. The advance trade report had the goods and services deficit expanding to -$69.2 bln from -$64.4 bln in December.

- Canadian IVEY PMI – IVEY PMI for February is anticipated to have a pickup in the seasonally adjusted measure to 58.0 from 57.2.

- Canadian Trade – The January trade balance is expected to improve to C$1.0 bln from C$0.9 bln in December. The C$1.0 bln surplus in November ended a lengthy run of deficits. Crude oil prices were modestly higher in January, but natural gas prices dipped slightly, suggestive of a modest boost overall to energy export values. Exports are seen rising 1.0% m/m in January after the 0.8% gain. Imports are projected to increase 0.8% in January after the 1.0% rise in December. The risk around the trade report projection is elevated, as always. Canada’s economy appears to be on the mend, although the trade outlook remains subject to considerable uncertainty.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/07 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.