FX News

European Outlook: Stock markets headed south in Asia overnight, after the Trump induced stock market rally started to run out of steam in Europe and the U.S. yesterday. The Topix fell for the first time in three days as the Yen advanced and investors turn cautious after pushing indices to very high levels and the prospect of tighter monetary policy comes back into focus. Electronics companies and banks retreated ahead of Yellen’s speech on the outlook for the economy to executives in Chicago today. In Hong Kong developers were hit by concerns of a March rate hikes. The Dow Jones still managed to close above 21000 yesterday, in Europe FTSE 100 and DAX held the 7300 and 12000 levels, but once again markets are reluctant to push things further at the current junction. Oil prices are slightly higher on the day, but still below USD 53 per barrel. The calendar has German and Eurozone retail sales, as well as the final reading of Italian Q4 GDP, but the focus is on the final round of Eurozone services PMIs as well as the U.K. services PMI.

Fedspeak: Fed governor Powell states: “we are as close to our mandate as we have been in a very long time, with a March hike “on the table” for discussion, with potential for 3 rate hikes this year as he’s indicated in the dots. In a CNBC interview, he doesn’t want to see the “animal spirits” get into the real economy as the outlook reaches a balanced state. He doesn’t see any excess in the credit markets or leverage per se, with solid economic momentum. Global growth risks are lower, with growth and inflation ticking higher, which is supportive of the outlook. Fiscal risks are also clearly upward, though awaiting details and not incorporated into his forecasts. We are very close to our 2% inflation target, which is a symmetric goal (neither above, nor below). Powell notes that shrinking balance sheet will take some time once rates are “well above” zero, done in a very predictable almost automatic way. He wouldn’t comment more specifically as the topic is currently under discussion at the Fed. Overall, he seems to be singing from the same hymn sheet as the others who’ve turned more hawkish of late.

US reports: 19k initial claims plunge to a 44-year low of 223k in the week of President’s Day leaves a super-tight level of claims over the seven weeks since the period of winter holiday volatility ended. Claims are averaging just 234k in February, versus prior averages of 247k in January, 258k in December and 252k in November. The 242k February BLS survey week reading sits at the low end of recent BLS readings of 237k in January, 275k in December, and 233k in November. The last time claims were as tight as yesterday’s figure was the 222k reading in March of 1973, when covered employment was just 56.4 mln, or 41% of the recent 138.9 mln.

Canada: Better than expected Q4 GDP and December GDP was taken in stride, given the dark view of recent upbeat data advanced by the BoC in Wednesday’s announcement. The loonie lost further ground amid widening Canada-U.S. yield spreads and a more than $1 pull-back in the price of crude oil. Canada’s Q4 GDP growth was driven by net exports and consumption. Consumption spending barely slowed in Q4, running at 2.6% after the revised 2.7% pace in Q3. Consumption added 1.9% to Q4 GDP after the 1.1% addition to Q3. But net exports were the engine of GDP growth, making a 5.2% contribution after the 1.2% add in Q3. Exports improved by only 1.3% in Q4 after the 9.4% bounce in Q3, while imports plunged 13.5% after a 4.8% gain. The imports decline was at least partly due to a one-time factor: the one time import of an oil module for an oil project in September left a big drop in October import values.

Japan: Japan’s core CPI grew 0.1% y/y in January, marking the first expansion since the 0.1% gain in December of 2015. The core CPI (which excludes perishables, but not gasoline) bottomed out with -0.5% y/y declines in July, August and September of 2016. Hence, the BoJ’s extraordinary accommodation has had some impact, but underlying inflation is still a long way from the 2% goal. Total CPI grew at a 0.4% y/y rate in January after the 0.3% pace in December. But the Tokyo core CPI saw a 0.3% y/y drop in February, matching the 0.3% y/y decline in January. Total Tokyo CPI fell 0.3% y/y after a 0.1% gain. Meanwhile, the unemployment rate slipped to 3.0% in January from 3.1% in December. Household spending tumbled 1.2% y/y in January after the 0.3% decline in December. USDJPY has slipped to 114.21 from a 114.58 peak late in the North American session.

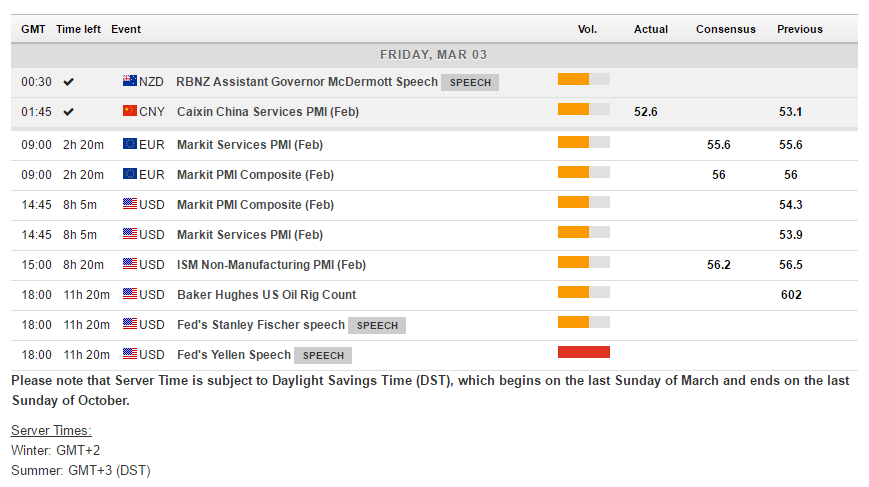

Main Macro Events Today

- Fed’s Yellen – Fed Chair Yellen speaking at an event before the Executives Club of Chicago.

- Fedspeak – Friday is a busy day for FOMC members, with the dovish voter Evans, Powell and hawkish non-voter Lacker speaking on a panel. Also, Fischer will discuss Fed policy decision-making at the Chicago Booth School’s annual policymaking forum.

- US ISM Non-Manufacturing PMI –February service sector producer sentiment is out today to close out the month’s series of reports. It is expected the headline to hold steady at 56.5 from last month. February producer sentiment has been very strong with increases in all the early month measures. This strength should allow the ISM-adjusted average of all releases to climb to a cycle high matching 56 from 54 in January and 53 in December.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/07 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.