USDJPY, H1

Prospects for Fed rate hikes and record highs on key Wall Street indices haven’t been managing to generate an underlying bid in the dollar, which is the worst performing of the main currencies on the year-to-date. Brexit negotiations start next month and risk being rougher than smoother, with a leaving bill for exiting the EU costs likely to be a contentious issue right from the get go. So far, the yen has traded weaker after rallying on a safe-haven bid yesterday following the comments from new U.S. Treasury Secretary Mnuchin. Mnuchin had spoken of an “excessively strong” dollar. Additionally, European stock markets are heading south, following on from losses on most Asian markets. U.S. stock futures are also down. Investors turned cautious in China amid concerns that markets are oversold and the ASX ended the weak lower as metal prices dropped.

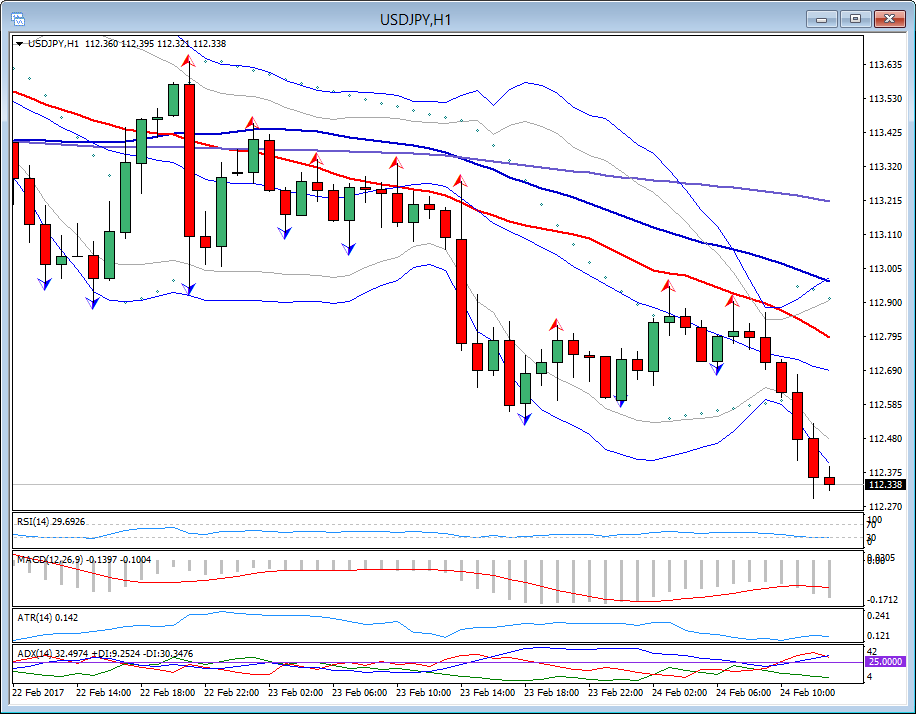

So far, USDJPY has ebbed to a 15-day low at 112.30 amid yen demand, with EURJPY and other yen crosses also heading south. The yen safe haven play is reflective of a waning in the reflation trade, with investors wanting more detail on Trump’s tax cut intentions and regulatory reforms while harboring some concerns about the prospects for protectionism.

In an hourly chart, USDJPY manage to brake the lower Bollinger bands pattern, as can been seen by the two-last candle. In the higher timeframe, 4-hour chart, Parabolic SAR, remains negative, since Wednesday’s turn. Additionally, on the 4-hour chart, last fractal has been broken downwards, with RSI at 34 sloping down and the MACD is negative. All these technical moves, presented in the 1-hour and 4-hour chart, suggest that weakness noticed during the week, might continue for a while.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/02/28 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.