The Fed’s commencement of its corporate bond buying program, along with reports that the Trump administration is planning a $1 tln fiscal stimulus program, injected some optimism back into global markets, which in turn led to higher Stock market, Oil prices and higher commodity currencies, including the Canadian Dollar.

Together with details of the Fed corporate bond program and additional lending volumes from the BoJ this helped to boost stock markets and strengthened risk appetite. GBP and EUR both lifted against a generally weaker USD and JPY which took a downward shift against most currencies as risk appetite picked back up. These developments have been tonic for markets, which have been concerned about a number of coronavirus flare-ups in various places across the globe. Regarding the coronavirus, Beijing reported a drop in the number of new coronavirus cases, to 27 from 36 yesterday, which also fed the rebound in investor spirits.

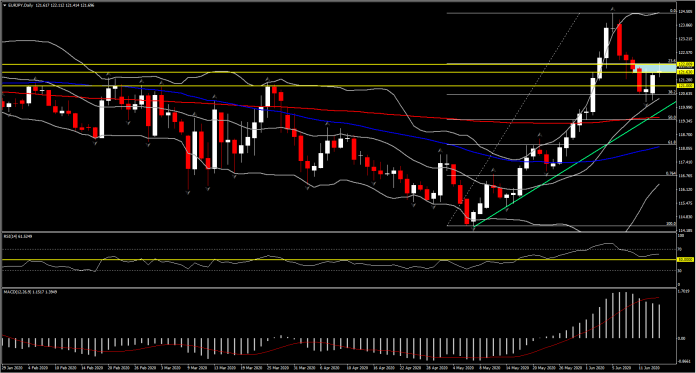

The Yen is generally under pressure against all majors as safe haven demand recedes. Even though GBPJPY posted the biggest rally today out of the Yen crosses, our attention turned to EURJPY after the asset formed a morning star formation on yesterday’s close, despite Friday’s doji candle. The asset rejected the 1-year high on June 5 (124.42) and drifted lower by nearly 420 pips, reverting nearly 38% of its 4-week gains from the 114 bottom. It found ground though at the 20-DMA (120.24). Even though the short term outlook looks contentious as the asset stalled in the 121.30-122.00 range, the overall outlook remains positive and well supported by the 20-DMA since May.

The RSI has been sustaining a move above 50 since mid-May, while MACD is declining below its signal line on near term selling pressure, but s sustaining a significant distance above the neutral line, with both presenting that the medium and long term outlook remains positive.

Hence the 38.2% Fibonacci at 120.63 of the upleg from 114.40 to 124.42, along with the round 120.00 could provide key Support level for the asset while the 121.63-122.00 (20-Month DMA) could act as a strong Resistance in the long term for the asset. A breakout of the latter could bring the 124 area into the spotlight, while if it fails and retreats below 121.00, the short-term bias would switch to bearish and could once again retest the 20-DMA and Friday’s low at 120.24. A deeper move could open the doors towards the 200-DMA and 50-DMA at 119.30 and 118.00 respectively.

Nevertheless, so far today the EUR has also been supported by German ZEW and reports on the recovery fund. German ZEW investor confidence jumped to 63.4 in the June reading, from 51.0 in the previous month. A much stronger result than we expected and in fact the highest reading since early 2006. The number ties in with the strong rebound in stock markets, which in turn is also the result of the ECB’s aggressive stimulus policy that is flooding markets with cash. Together with expected fiscal stimulus, this is helping to underpin confidence in the recovery. The current conditions indicator meanwhile also lifted, but slightly less so and at -83.1 that number still remains firmly in negative territory, highlighting that pessimists far outnumber optimists. Indeed, the recovery is likely to be more drawn out than initially expected, with a U, rather than a V shaped pick up now the central scenario at the ECB too.

Key will be how effectively economies will be in reopening without causing a significant resurgence in coronavirus infections.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.