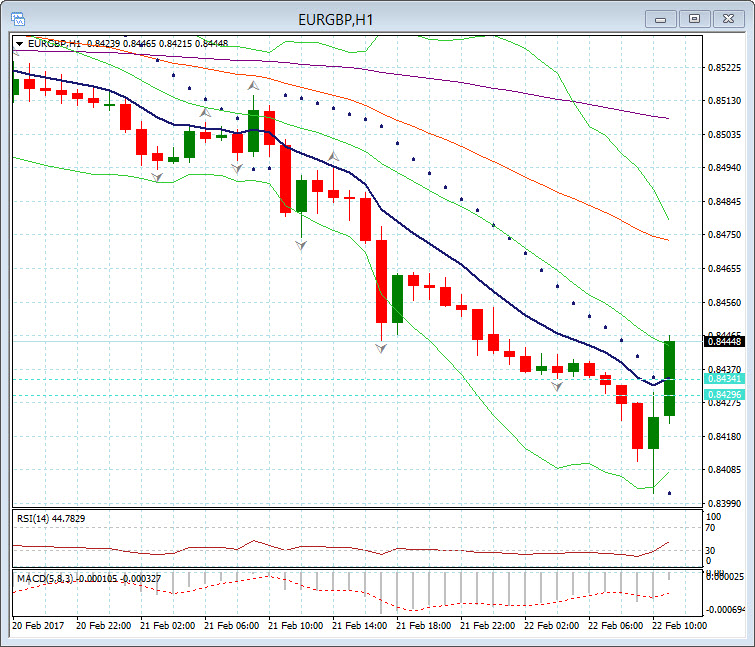

EURGBP, 1H

German Ifo confidence bounced back in February, with the headline reading rising to 111.0, from 109.9 in January and matching the December figure. Strong orders data already hinted at a rebound in the Ifo, while we expected a slight rise in the number, consensus expectations were for a renewed decline, so the data are much stronger than anticipated. The breakdown for the diffusion index, which gives the balance of positive and negative answers, confirmed that the rise in the overall index, was driven by a rebound in manufacturing sentiment. Wholesale trade numbers also improved, but construction and retail trade suffered setbacks. The uptick in inflation will eat into real disposable income.

Meanwhile, UK final quarter GDP data for 2016 was a good and bad report. The quarterly figure was revised upwards to 0.7% from 0.6% principally fueled by a big jump in exports to 4.1% from the 2.0% expected. The annual figure was a miss at 2.0% from the expected 2.2% and business invest was a significant miss coming in at -1.0% when expectations were for a slight growth of 0.1%. Additionally there was very low income growth with employee compensation increasing only 0.1% following a 1.3% rise in Q3 and below expectations.

Cable fell on the news to break 1.2440 to trade as low as 1.2434. The EURGBP 1 hour chart had a sudden and rapid “about turn “ following the German and UK data, rising from morning lows just shy of 0.8400 to currently trade north of the 10 and 20 period moving averages at 0.8445. The 10 period EMA has now broken and is likely to provide support (0.8435) as Euro recovers from the morning low. The break of the last down fractal at 0.8430 is also likely to provide support. The break of the 20 period moving average (0.8445) needs to hold for further upside in the short term to the 4 hour resistance at 0.8460.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/02/23 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Senior Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.