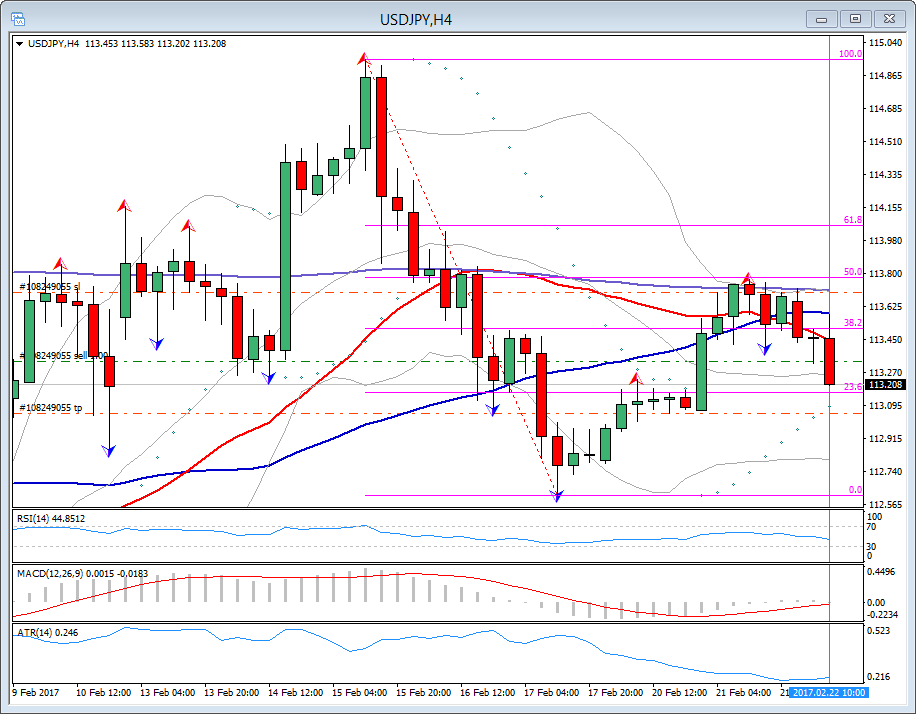

USDJPY, H4

The dollar has been trading so far today, advancing against the euro into the London open while showing a more net indifferent profile versus other currencies. The euro has come under fresh pressure. EURUSD has breached last Wednesday’s low at 1.0521 and logged a six-week low at 1.0519. EURJPY is also lower, trading at 12-day lows, and EURGBP has forayed into two-month lows. Concerns about Frexit are dominating over what has been a continued run of forecast-beating data out of the Eurozone through to yesterday’s flash February PMI surveys. More of this theme seems likely as currency reserve managers, corporations and investors hedge for the worst. USDJPY has lifted off its 113.33 low, recouping to around 113.50, amid a bullish session in Asian stock markets, which followed a record-high-producing rally on Wall Street on Tuesday. The pair traded as low as 112.62 last Friday, so the yen remains at lower on the week, although it has gained versus the beleaguered euro. USDJPY logged a five-session high at 113.77 yesterday. Cable has ebbed under 1.2500 after failing to sustain a number of rises above here over the last day. AUDUSD has eked out three-session highs just shy of 0.7700, with the Aussie benefitting from the risk-on backdrop.

Today, USDJPY retreated to its lows after early flurries higher stalled just shy of 113.60. The yen has struggled to weaken despite the record-high-producing rally on Wall Street yesterday and a mostly positive session on Asian bourses today. The pair traded as low as 112.62 on Friday last week, so the yen still remains at net low levels on the week versus the dollar, though has posted gains against the beleaguered euro. USDJPY clocked a five-session high at 113.77 yesterday.

Additionally, today pair manage to break the crossing 50-period MA and 200-period EMA, on the hourly chart and has prompted a SHORT position, with the 14 period ATR at 12 the target is around 113.00-10 and set at 113.08. On the higher timeframe of 4-hour chart, last fractal has been broken, the MACD is negative, at 45 the RSI is neutral sloping down, while on the 1-hour chart parabolic SAR turned early today. Resistance to a further down move is at 113.70.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/02/23 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.