FX News

European Outlook: Asian stock markets moved mostly higher, with property developers and automakers leading the way in China, but gains in Japan trimmed later in the session by a stronger Yen and the ongoing slump in oil prices. The front end Nymex future is currently trading at USD 51.76 per barrel, after data showing a rise i U.S. stockpiles, fuelling concerns that rising supply from the U.S. will offset cuts by OPEC. U.K. futures are moving higher, U.S. stock futures are narrowly mixed. In Europe only DAX and FTSE 100 managed to close with gains on Tuesday, while other markets were in the red. Yields declined as bond futures advanced and the French 10-year for once managed to outperform the German equivalent, but the Eurozone remains in the shadow of election jitters and mounting political risks inside and outside the union. The local data calendar today is pretty empty and with only business confidence data from the Bank of France on the agenda, political risks will remain a focal point.

US: U.S. December trade deficit narrowed 3.2% to -$44.3 bln after rising 7.1% to -$45.7 bln in November. Imports rose 1.5% versus the 1.2% gain previously, while exports were up 2.7% versus -0.2% in November. The “real” goods trade balance was -$62.3 bln compared to -$63.9 bln as imports rose 1.5% while exports increased 3.6%. U.S. JOLTS report showed job openings dipped 4k to 5,501k in December after rising 54k to 5,505k in November (revised from 5,522k). Also, the rate slipped to 3.6% from 3.7%. December hirings rose 40k to 5,252k following November’s 52k increase to 5,212k. The rate was flat at 3.6%. Quitters dropped 98k to 2,979k in December after rebounding 54k to 3,077k in November. The rate fell to 2.0% from 2.1%. The JOLTS report an important indicator for Fed Chair Yellen, particularly the quit rate, so the data will be slightly disappointing, but not really market moving.

Canada: GoC were ultimately little changed to firmer, with the long end of the yield curve outperforming. Equities managed to maintain a small gain late into the session, despite a drag from energy sector shares amid a tumble in crude oil prices. The loonie saw modest improvement against the U.S. dollar, despite the oil price decline and the not exactly surprising news that Canada ran a second consecutive trade surplus in December. Canada’s trade surplus narrowed to C$0.9 bln in December, which was better than expected and modestly below projection of C$1.2 bln. The November surplus was revised higher to C$1.0 bln from the original C$0.5 bln, leaving a narrowing in December despite what was a firm figure. Exports improved 0.8% m/m in December after a revised 5.1% surge in November (was +4.3%), driven by higher prices on energy products. Imports grew 1.0% on the heels of a revised 0.2% dip in November (was +0.7%), with December’s gain mostly due to an increase in aircraft and industrial machinery.

Fedspeak: Fed’s Kashkari said yesterday, it’s better the Fed errs on the accommodative side than on being more restrictive, in an essay he wrote to explain his vote on February 1. He noted that he “avoids making predictions about when our next rate change will be and how many changes I expect in a given year, in order to minimize confusion and because the Fed doesn’t know for sure how the economy will evolve, where he also acknowledged the Fed has often been wrong. He also added that there are too many uncertainties, including the fiscal policy outlook. Inflation is expected to remain well anchored, with the strong dollar likely to restrain price pressures. Wages aren’t showing much inflation either. In conclusion, he said from a risk management standpoint, “we have stronger tools to deal with high inflation than low inflation.” Hence, he voted to keep rates steady.

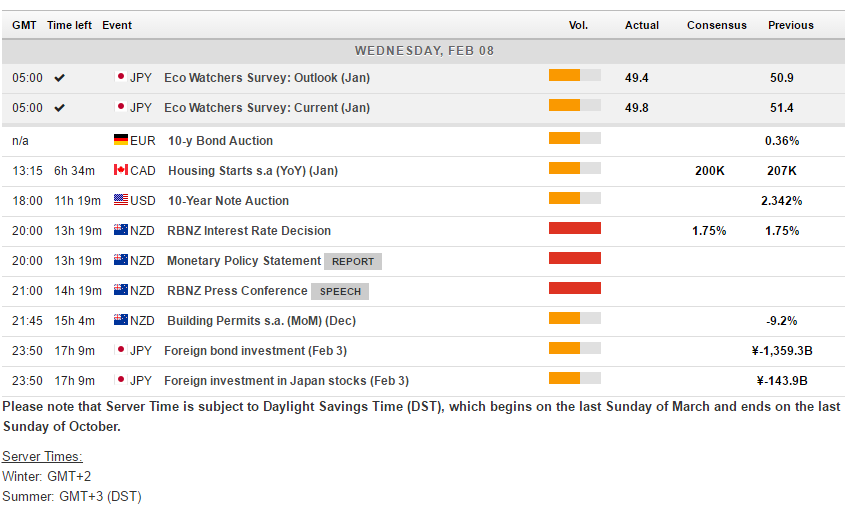

Main Macro Events Today

- CA Housing Stats – Canada’s Housing starts are expected to slow to a 200.0k unit pace in January from the 207.0k rate in December. Permits grew at a 233k to 235k pace over the three months spanning October, November and December.

- NBNZ Rate – Reserve Bank of New Zealand’s meeting, expected to result in no change to the 1.75% rate setting.

- NZ MPS & Conference – RBNZ will publish today the Monetary Policy statement. Afterwards a press conference will also be held by Reserve Bank Governor regarding monetary policy.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/02/09 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.