FX News

European Outlook: Asian stock markets mostly headed south ( Nikkei closed own -1.22% at 18, 914) ongoing concerns about am emerging global trade war, and as the dollar weakened after the Fed failed to signal a rate hike as early as March, which some expected after yesterday’s data round. Oil prices fell back and investor confidence ebbed. Meanwhile the tense transatlantic mood and the apparent desire by the new U.S. administration stir discord in the Eurozone and the EU with the aim of breaking up of the union, should keep Eurozone spreads on a widening path. This backdrop, if it sustains, this will make it less likely that the ECB will end its very accommodative monetary policy, and keep the euro on the back foot. The UK parliament voted in favour of the government to trigger Article 50 and today the Brexit White Paper will be released.

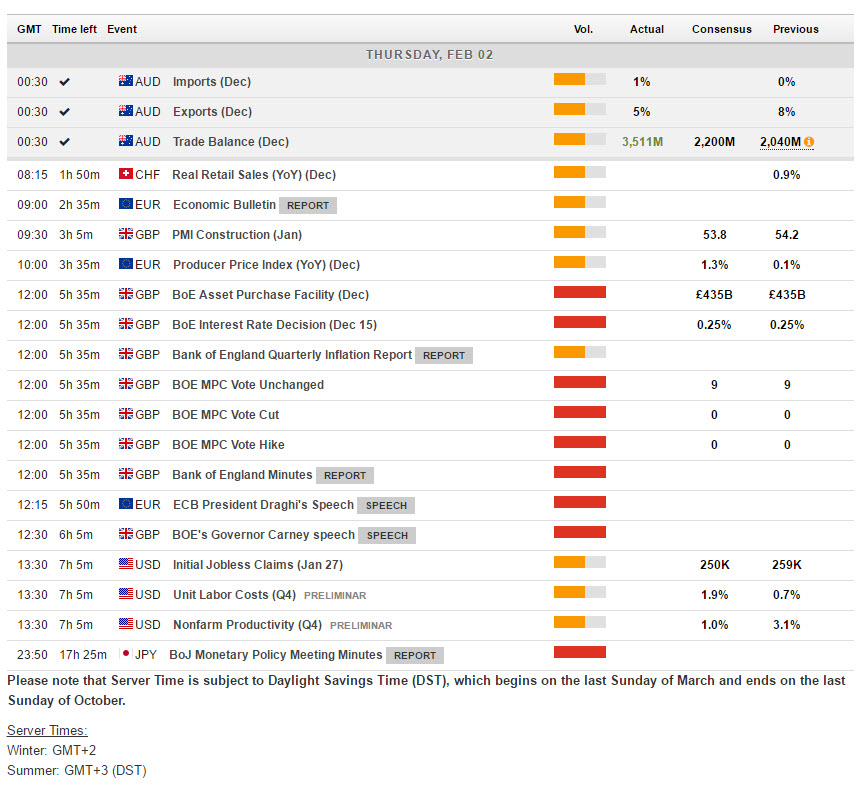

Australian Trade – A Record Surplus: Imports rose to 1% from 0% last time and Exports fell to 5% from 8% which grew the trade balance much more than expected to record AUD 3,511Million from AUD2, 040 million last time and an expected figure of AUD2, 200million. The record trade balance was due mainly to significant increases in commodity prices and prevented Australia slipping into a “technical” recession for Q4 2016.

The FOMC Statement: FOMC said inflation “will rise to 2%” over the medium term, and that economic activity continued to expand, while the labor market continued to strengthen. There was no change in rates, as projected. The FED also gave itself maximum flexibility to act in March, or not, if it deems it necessary as the policy statement neither put the markets on notice, nor did it signal the all-clear. Many factors will go into the policy decision next month. While stronger data and rising inflation pressures may push some of the more hawkish Committee members to argue for a 25 bp hike, the current voters, including Evans, one of the most dovish participants, along with the centrist Kashkari would likely prefer to delay, especially if political uncertainties remain high and if fiscal stimulus looks to be farther out the timeline. Additionally, the markets could be shaky ahead of Brexit, as the UK moves closer to triggering that event, and the March 15 general elections in the Netherlands. With this backdrop, Fedspeak should be closely monitored. USD sagged following the announcement and overnight Cable touched 1.2680, the Euro perked to 1.0795 and Japanese yen traded down to 112.46. The US Dollar index is currently trading significantly under 100 at 99.43.

US data: U.S. ADP reported private payrolls surged 246k in January after a 151k gain in December (revised from 153k). The service sector climbed 201k from 147k previously (revised from 169k), while employment in the goods producing sector rose 46k from December’s 4k gain. The U.S. ISM surge to a 2-year high of 56.0 from prior highs of 54.5 in December and 53.5 in November lifted January nonfarm payroll estimates to 200k from 190k, as the index continues to climb steeply from the 47.9 expansion-low in December of 2015. The jobs component surged to a 29-month high of 56.1 from an 18-month high of 52.8 in December.

Main Macro Events Today

- BoE Super Thursday – Today the BOE announce it interest rate decision, (very likely to remain unchanged) along with its asset purchase facility (again likely to be unchanged) the minutes and votes from their last meeting and also the Quarterly Inflation report (the most interesting data) The minutes and inflation report are expected to convey a continued wait-and-see stance, repeating that policy could go in either direction this year. Finally governor Carney and members of the MPC hold a press conference regarding the Inflation report (likely to be by far the most interesting).

- ECB President Draghi Speech – The speech in Slovenia may be more interesting and market moving than his speech on Monday but markets seem to be in a Trump On / Trump Off mood rather than Risk On / Risk Off.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/02/01 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Senior Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.