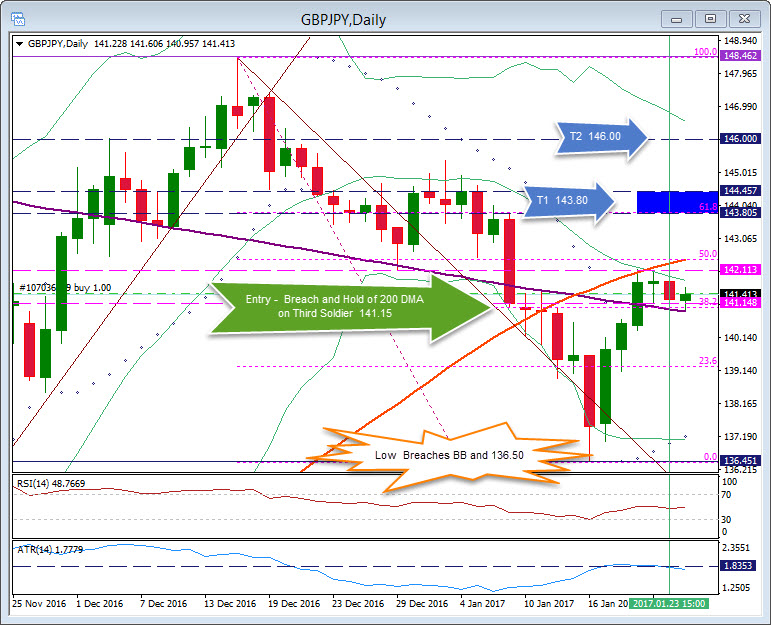

GBPJPY, Daily

GBPJPY, the longtime preferred pair of the large FX hedge funds, appeared to make a bottom last week which it has recovered from in traditional style. The Guppy or Widow maker spiked down to 136.45 last Monday (January 16) before reversing aggressively following the UK PMs Theresa Mays 12 point plan for Brexit speech. The three day (3 Soldier) move up punctured the 200 DMA on Thursday (January 19) and has remained north of this key level since then. A long position was taken at 141.15 with target 1, little beyond the 14 DATR and t the 61.8 Fibonacci level at 143.80 as this trade is with the longer term trend. Target 2 is close to the outer Bollinger band and at the psychological 146.00. 142.00 remains a key resistance level as it is also the confluence of the 20 & 50 DMA and the 50.0 Fibonacci level. RSI and MACD are neutral, however, the Parabolic SAR reversed on January 17.

https://analysis.hotforex.com/ has had a 100% start to 2017 with five trades achieving both Targets 1 and 2 and this sixth trade hitting target 1 for a total net gain of 1218 pips.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join me TODAY (Tuesday) at our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/24 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.