FX News

European Outlook: Asian stock markets traded mixed, with Japan and ASX moving higher, as Fed’s Yellen said she expects to hike rates few times a year through 2019 to 3% neutral rate. The weaker Yen helped to underpin Nikkei and Topix, while the drop in energy prices added to pressure on Chinese stocks with energy producers and miners leading the way down. The front end WTI future has lifted somewhat, but remains firmly below USD 52 per barrel. U.S. stock futures are also down, while FTSE 100 futures are posting gains, despite a stronger Pound. In Europe the focus turns to today’s ECB announcement, where Draghi is widely expected to keep policy on hold and will be under pressure to defend the ECB’s QE extension as inflation lifts higher and growth remains strong. The calendar also has Swiss producer price inflation and Eurozone BoP and current account data for November.

BOC: Larger Question Marks on the Outlook; The Bank of Canada delivered the widely expected lack of change to the 0.50% rate setting alongside a modestly more upbeat domestic and global growth outlook. The outlook is largely similar to October, but the degree of uncertainty has increased according to Governor Poloz. Hence, the Governor, in his Q&A, said that a rate hike remains on the table. While the outlook remains very uncertain, consensus is to see no change in rates for an extended period as the most sensible base-case policy scenario.

Fed Chair Yellen: Said she can’t give the timing of the next hike, but noted the Fed is close to meeting its twin goals, in her comments at The Commonwealth Club. As suggested by the outcome of the December FOMC meeting and the dot-plot, she noted that she and most of her colleagues expect “a few” rate hikes a year. The next tightening will be a function of the economy over the coming months (that suggests a March move is unlikely). It makes sense for the Fed to gradually reduce monetary policy support.

US Data: U.S. reports revealed a hefty 0.8% December industrial production rise thanks to a 6.6% utility output surge that reversed the prior 9.7% weather-induced 3-month drop, alongside a 1.8% vehicle assembly rate bounce before a likely January drop-off, and a 0.7% business equipment rise that reversed a 0.7% November decline. Expectations are for a resumption of positive industrial production growth in 2017 led by a 2.4% Q1 clip, after a 0.6% weather-induced Q4 contraction rate that left a 7th decline over the last 9 quarters. We also saw the expected December CPI headline gain of 0.3% (0.282%), though the core price rise of 0.2% rounded down from a surprisingly firm 0.230% gain that sets the tone for bigger price gains in 2017.

Davos Speak: (from the BBC) Bills Winters and Briyan Moynihan, of Standard Chartered and Bank of America respectively, will be part of a panel examining the Global Banking Outlook.–Santander chairwoman Ana Botin forms part of a discussion on Which Europe Now?-Sheryl Sandberg, chief operating officer of Facebook, will discuss A Leader’s Resilience. Sergey Brin, co-founder of Google and founder of Bayshore Global Management, will be sharing his ideas. Bill Gates and GSK boss Andrew Witty take part in a discussion on CEPI: A Global Initiative to Fight Epidemics. Saudi Arabia and Russia will discuss the Global Energy Outlook. The UK PM Theresa May will pitch her Brexit plan to leaders and the Russian deputy PM Igor Shuvalov will talk about Russia’s place in the world.

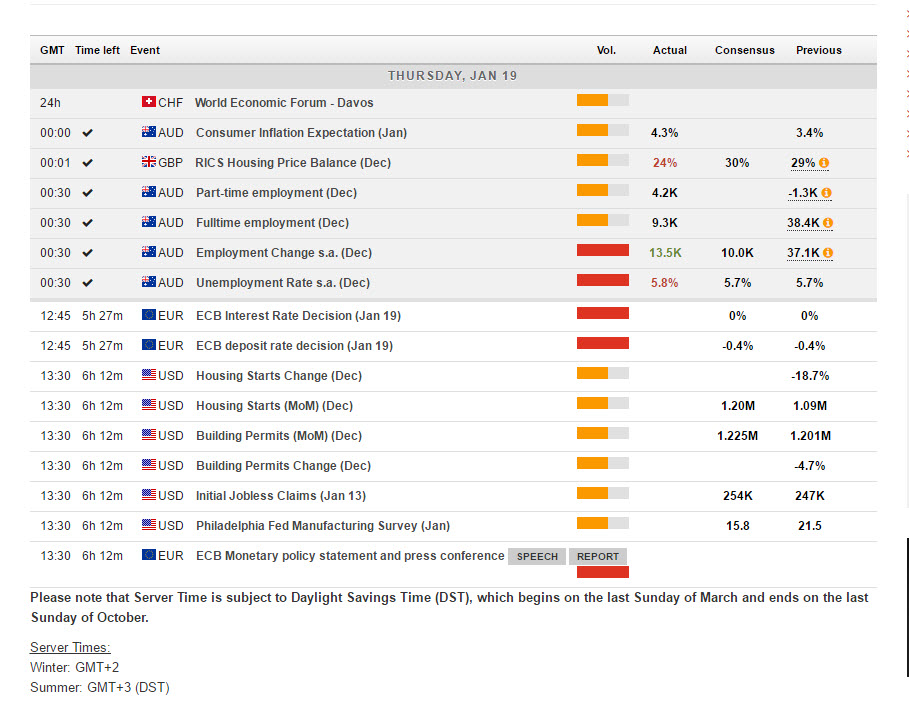

Main Macro Events Today

- ECB Rate & Statement – ECB is widely expected to keep policy on hold after clarifying the policy outlook through to the end of the year, with purchase targets cut back to EUR 60 bln again from April. The ECB obviously tried to create some stability at least on the monetary front amid heightened uncertainty on the political front ahead of the Brexit talks and amid the change in U.S. administration. However, with inflation jumping higher, the central bank’s policy is coming under more scrutiny again and much of the press conference will likely be an exercise in trying to play down the importance of the rise in HICP to the highest level since 2013 as the ECB is heading for a further expansion of its balance.

- US Housing Starts – Should reveal an increase in the pace of starts to 1,184k from 1,090k in November and a recent high 1,340k in October. Permits should climb to a 1,230k pace from 1,212k in November and completions should be 1,100k from 1,216k in November.

- US Phili Fed Index – Should reveal a headline decline to 15.1 from 19.7 in December and 8.7 in November. Revisions to the Philly Fed were released last week and lowered December’s headline slightly. More broadly, producer sentiment is expected to remain firm in January with the ISM-adjusted average of all measures rising to 54 from 53 in December.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/19 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.