EURGBP, Daily

German HICP confirmed at 1.7% y/y, as expected, with prices up 1.0% m/m. The sharp acceleration from just 0.7% y/y in November was mainly due to base effects from lower energy prices and the breakdown showed that prices for heating oil jumped 21.9% y/y in December, after still falling -6.7% y/y in the previous month. Petrol prices rose 6.0% y/y, after falling -2.2% y/y in December. Still, even excluding household energy and petrol, the annual rate jumped to 1.6% from 1.2% in November and the data will back the critics of Draghi’s expansionary policy in Germany. The Eurozone headline rate, remains lower, but has been conformed at 1.1% and is still trending higher – at least for now.

Across the English Channel, UK unemployment remained at the 11-year low of 4.8% in the official figure for November, as expected, while the December claimant count rate remained at 2.3%, although the claimant count fell 10.1k, more than the 5.0k decline expected. Total employment edged to a new record high in the three months to November. Average household incomes rose 2.8% y/y and 2.7% y/y in the respective with-bonus and ex-bonus figures for the three months to November, although the growth in real incomes are diminishing quickly with inflation rising.

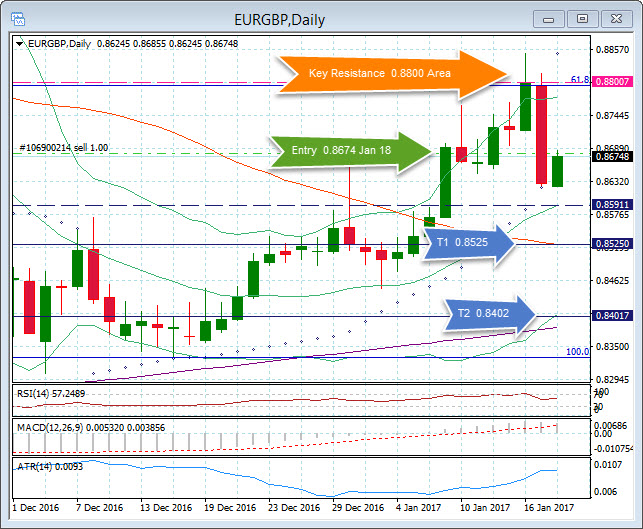

The move down in EURGBP yesterday to below 0.8650 has triggered a SHORT position entry at 0.8675 this morning with Target 1 at the 14 DATR and 50 DMA 0.8525. Resistance to a move lower is the 20 DMA at 0.8591, and we could see a bigger retrace of yesterday’s large move down before the down move is resumed. Target 2 is the lower Bollinger band at 0.8402. Upside resistance is the 61.8 Fibonacci level of the October – December move down which held on both Monday and yesterday at the psychological 0.8800 area. The parabolic SAR turned negative yesterday, however, the RSI having been north of 70 dipped to 54 yesterday but remains positive and also MACD remains positive. The longer term Weekly and Monthly trends are also positive so this position is a against the longer term trend.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/19 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.