FX News

European Outlook: Aftershocks from President-elect Trump’s campaign-like press conference, which had weighed on global stock markets and yields started to recede late in the U.S. session and U.S. equities managed to recover part of their losses. Asian markets rebounded led by Japan as the Yen weakened and U.S. and U.K. stock futures are also higher, while the front end Nymex future is trading around USD 53 per barrel. Bund futures already started to head south in the after hour session yesterday and core yields are likely to move higher in early trade. The European calendar only has the BoE’s credit conditions survey and the final reading for Spanish December HICP, leaving markets to focus on global developments.

FX Update: The dollar is trading softer into the London open, but remains comfortably above the post-Trump press conference lows. USD-JPY has ebbed to the upper 114s after failing to sustain gains above 115.00, but remains over a big figure up on yesterday’s one-month low at 113.75. EURUSD has firmed up to around 1.0630 after logging an intraday low in Asia at 1.0603, but still remains some 50 pips below yesterday’s one-month peak. While doubts have now crept in about U.S. president-elect Trump’s reflation plans following his fractious press conference on Wednesday, returning some support to the dollar have been Fed speakers, who were not been shy yesterday in warning of upside risks to policy in 2017, with the debate hottest over how quickly to hike rather than when to do so. Another batch of U.S. data today will help shape Fed policy expectations, though Trump may have his work cut out to reignite the sputtering Trumpflation trade.

U.S. Reports revealed surprising firmness in December export prices alongside a restrained oil-boost to import prices, and a largely expected 10k rise in initial claims to a still-firm 247k that signals a tight start for 2017. For trade prices, the relative firmness in export versus import prices trimmed Q4 GDP growth prospects, though we left our estimate at 1.6%. For claims, gyrations through the New Year’s week can be attributed to holiday volatility, though we’re encouraged that claims are starting January below the 258k December average. Next week’s BLS survey week reading will likely undershoot the 275k December BLS survey week figure. We expect a 180k January nonfarm payroll rise that matches the average monthly gain in 2016, though this average faces a likely downward bump with the next report’s annual revisions.

Fedspeak: Chair Yellen’s speech contained surprises and keynote comment was that sh e thought “short term I would say I don’t think there are serious obstacles. I see the economy as doing quite well” Fed’s Bullard maintained a rather circumspect outlook on policy and the economy. He projects only limited movement in rates, reiterating his views noted earlier of perhaps only 1 tightening this year and noting there is little reason to alter policy as the Fed nears its goals. There shouldn’t be any undue pick up in inflation. Job growth is likely to slow this year and next. And in terms of the new administration’s policies, he said it’s questionable what will actually occur. Bullard is not a voter this year. Kaplan: Fed should be removing accommodation in 2017, with growth forecast at greater than 2%, even without any fiscal boost. The U.S. is pretty near full employment and inflation is heading to 2%, though there’s some slack in the labor market and more demand than supply for skilled workers. He expects regulatory review and tax reform to help boost productivity, along with infrastructure investment. Kaplan said he will be scrutinizing decisions on trade, immigration and Obamacare for any impact on growth, while manufacturing plants need to be allowed flexibility in supply chains. This about par for the course, with the Fed evidently predisposed to normalize rates in 2017 all else equal.

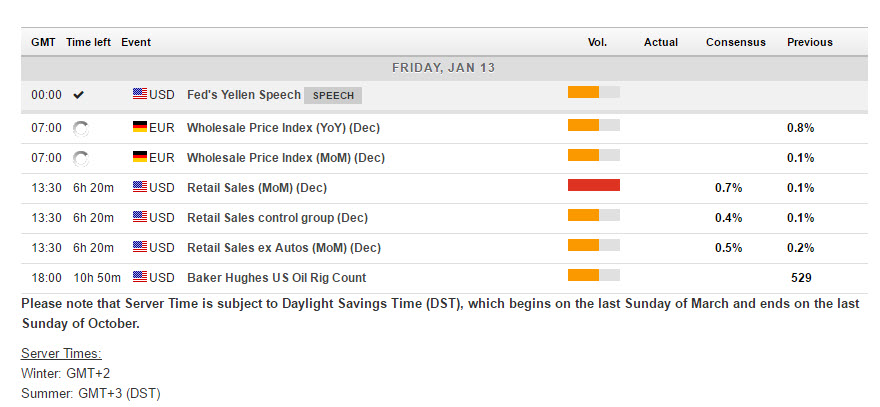

Main Macro Events Today

- US Retail Sales – December retail sales data is out today expectations are for a 0.7% headline with the ex-autos aggregate up median 0.5% on the month. This follows November data which had the headline up 0.1% and ex-autos up 0.2%.

- US PPI Data – December PPI data has expectations to post a 0.3% with the core index up 0.2% on the month. This compares to respective November figures which posted a 0.4% headline and a 0.4% increase for the core. Despite the fact that oil prices remain at depressed levels we did see a 14.0% climb in WTI prices in December which could lend some support to the headline.

- US Michigan Consumer Sentiment – The first release on January Michigan Sentiment should reveal a headline increase to 98.5 (median 98.4) from 98.2 in December and 93.8 in November. Consumer confidence measures have been posting improvements since the election and the January IBD/TIPP poll has already reveal an increase for the month with a rise to 55.6 from 54.8 in December.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/17 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.