FX News

European Outlook: Stock markets headed south in Asia overnight, with Japan underperforming and the Nikkei closing with a 1.19% loss as the strength of the yen weighed on exporters. The first press conference of the incoming U.S. administration disappointed and initially sparked a fresh bout of volatility, with investors taking a wait and see stance now to get a clearer picture of what lies in store going ahead. U.S. and U.K. stock futures are also heading south and the Bund future, which outperformed yesterday, lost much of its gains during the PM session. Eurozone spreads narrowed yesterday and the German yield curve flattened as the short end underperformed, while the U.K. yield curve steepened on short end outperformance. Today’s calendar has the first estimate of German 2016 GDP, seen at 1.9%, up from 1.7% in 2015. The calendar also has Eurozone production data for November, as well as the final reading of French December HICP and the ECB’s minutes for the Dec meeting.

The Dollar got Donalded: Trump conducted a test of the intelligence community by having a meeting with those agencies without letting any of his staff know and news of that meeting was subsequently leaked, he said. That would certainly explain his skepticism about the intelligence community’s motivations and secrecy. His conference roamed wildly across the range from fake news, to reaffirming the Mexico wall will remain an urgent priority (the peso plunged through 22.0), along with the relationship with Russia, Pharma pricing, hacking protections, the Trump Trust, Veteran’s affairs, etc. The conference was wide ranging and characteristically frank, leaving the press on their heels and markets chomping in ranges, but not essentially charting a new course. He was all rather vague and the markets reacted accordingly, the USD fell from its heady heights and continued to decline overnight. EURUSD sits at 1.0630, USDJPY under 114.50 (at one month lows) and Cable over 1.2240.

Carney: BoE Governor Carney said Brexit-related risks have “gone down” during testimony, in terms of what he described as the immediate scale of risks, before a parliamentary select committee. However, he warned that a disorderly Brexit process, where there is no transitional arrangements, could lead to “unforeseeable moves in markets.”

Fedspeak: NY Fed’s Dudley spoke on reforming the culture in banking, in his written text on “Remarks at the Culture Imperative — An Interbank Symposium.” He noted the NY Fed was prompted to work on this issue after the LIBOR manipulations and misconduct highlighted the importance of culture. He believes evidence points to an industry wide problem, across firms and countries. Also, he stressed that reforms must be industry driven, while not denying the importance of regulation. He did not discuss monetary policy.

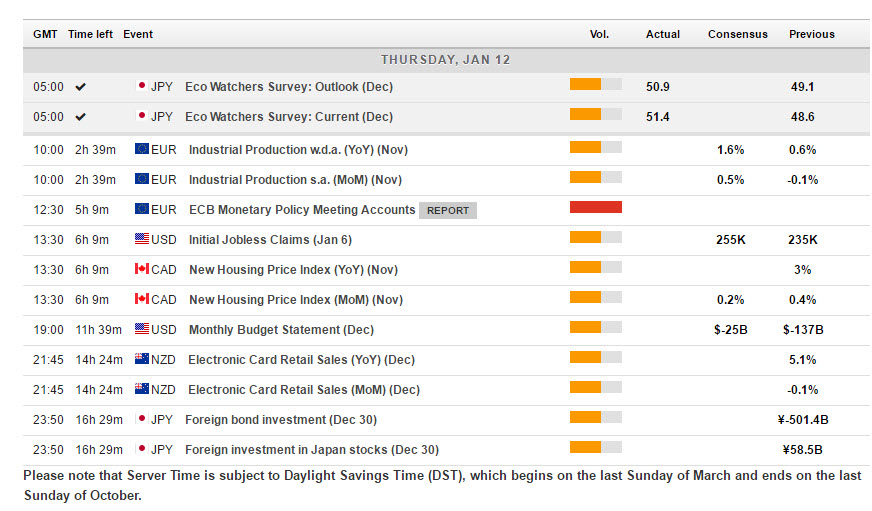

Main Macro Events Today

- German 2016 GDP The first estimate for full year 2016 GDP is as usual released before the Q4 numbers are out, but with expectations for a robust fourth quarter growth rate, is widely seen at 1.9%, up from 1.7% in the previous year. The numbers will confirm that Germany is on a solid growth path, and confidence indicators suggest that this will remain the case in the first quarter this year, although going ahead, there are numerous downside risk.

- US Import & Export Prices December trade price data should reveal a 0.7% increase for headline import prices and a 0.2% decline for export prices on the month. This follows respective November figures which had import prices down 0.3% with export prices down 0.1% for the month. Oil prices resumed there rebound in December so there is some upside risk to import prices.

- US Initial Jobless Claims Initial claims data for the week of January should reveal a 252k headline, up from last week’s 235k which marked a low extending all the way back to the1970’s. Claims are expected to average 258k in January, about matching December’s 257k average and up from 252k in November.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/12 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.