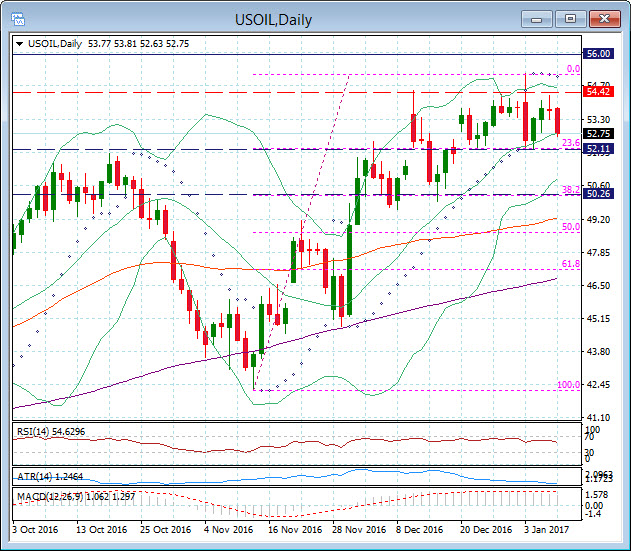

USOIL, Daily

US crude oil is down 2% in early N.Y. trade, printing $52.84 lows, after closing Friday at $53.99. Ten straight weeks of additional U.S. oil rigs coming back on line has been a driver, with potential for U.S. production to eventually negate much of the agreed OPEC/non-OPEC output cuts. Barclays forecast that U.S. producing rigs would increase to as many as 875 by year end, from the current 529. At the same time, Iraq reportedly shipped record amounts of crude in December, while Reuters reported that Iraq’s state oil company had promised three Asian customers full February allocations.

I remain fairly positive on Oil prices following the OPEC agreement at the end of November and my post from December 5. The psychological $50.00 and $52.00 support levels have remained and following the recent peak at $55.22, also represent key Fibonacci retracement levels, (38.2 and 23.6 respectively). The 20 DMA has also provided support during the run up during December. The higher time frame weekly and monthly charts are positive with target 1 at $56.00 and target 2 $62.00.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/10 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.