FX News

European Outlook: Asian stock markets were mostly down, led by a slump in Japan, as the Yen rose across the board. The weakness in Asia followed a decline on Wall Street yesterday set off by disappointing U.S. data that sent the USD into retreat. Oil prices also dropped and the front end WTI future is trading below USD 53 per barrel again despite approaching production cuts. The ASX still managed to post slight gains and some Chinese indices clawed back some of their recent losses while trading volumes perked up a bit. U.S. and U.K. stock futures are still down, however, setting the European market up for further weakness, although the DAX is still poised to end the year with a solid gain, as the ECB continues to lend a helping hand. With the ECB still on an asset buying spree, Eurozone yields remain under pressure and especially the short end continues to drop to new lows after Draghi removed the deposit rate floor for bond purchases. UK Nationwide house price index Dec mm +0.8% vs +0.2% expectations and year on year increase up to 4.5% from 3.8% expected.

FX Update: Overnight the Yen rose strongly – USDJPY fell from yesterday’s high at 117.80 to currently trade at 116.23, GBYJPY collapsed to under 143.00 and EURJPY is trading at 121.65 down from yesterday’s high of 123.26. The USD has also retreated against the EUR (back to 1.0450 from yesterday’s multi week lows at 1.0370) and GBP (1.2250).

Yesterday’s U.S. reports: US pending home sales fell 2.5% to 107.3 in November after rising 0.1% to 110.0 in October. Sales have been on a choppy, saw-toothed course for more than a year. Regionally, sales declined in the West (-6.7%), the Midwest (-2.5%) and the South (-1.2%), but rose slightly in the Northeast (0.6%). On an annual basis, however, sales accelerated to a 1.4% y/y clip versus 0.2% y/y previously.

Germany: Italy must stick to new rules in bank aid. Like Bundesbank president Weidmann earlier in the week, the German Finance Ministry today stressed that a precautionary recapitalisation of banks, as planned by Italy, can only take place in exceptional circumstance and within the framework of the Eurozone’s strict rules. The latter also includes investor bail-ins and the ministry stressed again that the bank must still be solvent and that public funds must not be used to cover foreseeable losses. The ECB reportedly already said that in the case of Monte Paschi the bank remains solvent, but reports from earlier in the week also suggest that the ECB is pushing for a higher investor bail-in as the government had planned. Italy’s banking sector, which is struggling to cope with the high level of non-performing loans, will clearly be the acid test for the Eurozone’s new regulatory framework for future bank bailouts.

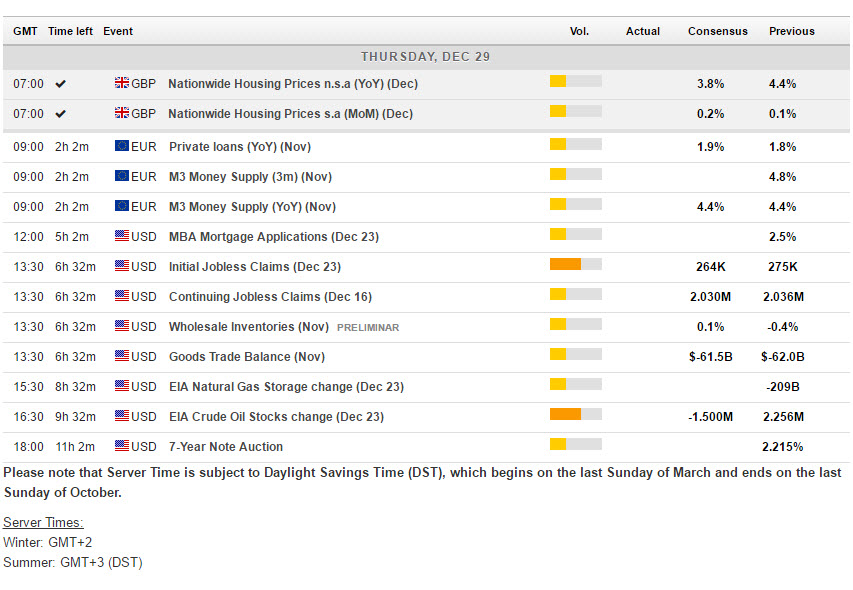

Main Macro Events Today

- US Initial Claims – Claims data for the week of December 24 is out today and should reveal a 275k (median 265k) headline, steady from last week and up from 254k the week before that. Claims have been striking a firm path since summer and are poised to average 259k in December from 252k in November and 258k in October.

- EIA Crude Inventories – Expectations are for a drawdown of up to 1.5 million barrels, following a build of 2.256 million last week. Overnight the private inventory survey has shown the biggest build in 6 weeks. Conflicting data is not that uncommon between the two agencies. The official EIA data is published at 16:00 GMT.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2016/12/29 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.