GBPJPY, Daily

UK government borrowing was worse than expected in November, with the figure net of lending to publically-backed banks coming in at GBP 12.6 bln, up from GBP 4.8 mln in the month prior and up on the median forecast for GBP 12.2 bln. While total government borrowing stood at GBP 59.5 bln, GBP 7.7 bln down from November last year, total government net debt rose to a new record high of GBP 1.66 tln, or 84.5% of GDP.d, 50 DMA and 38.2 Fibonacci retracement level of the recent move up to north of 87.4000. Also out this morning UK inflation expectations continue to rise, with a YouGov poll sponsored by Citigroup finding long-term inflation expectations among households rising for a fifth consecutive month in November (i.e. evey month since the late June vote to leave the EU), this time from 2.8% to 3.0% — the highest in 27 months. Long-term in this survey means five to 10 years. Over the next 12 months, households are expecting inflation of 2.43%, marginally up on the 2.36% expectation in October. The BoE is anticipating CPI to reach 2.7% next year. Currency weakness, a consequence of the UK’s course to leave the EU, has been driving prices and inflation expectations higher.

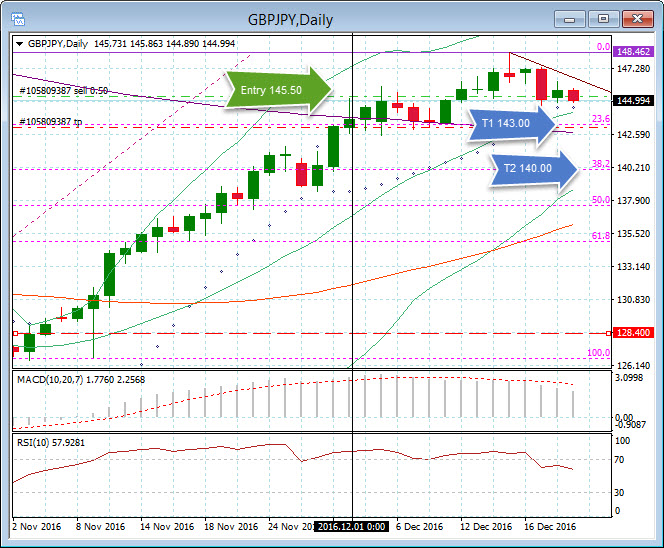

The GBPJPY looks vulnerable for a pull back, the strong rise during November and December may have peaked with what appears to be a pivot high and shooting star at 148.46. Monday’s (December 19) strong move down absorbed the five previous day’s energy. A SHORT position was entered today at 145.50 with Target 1 at 143.00 (the confluence of the 14 DATR, the 200 DMA and the 23.6 Fibonacci retracement level) and Target 2 at the 38.2 Fibonacci level and psychological 140.00. The MACD and RSI are suggesting further weakness. However, the pair remains north of the 20 DMA at 144.00 which could provide short term resistance to the move lower and the Parabolic SAR is still positive.

The EURJPY similarly, looks to be rolling over. The MACD and RSI are suggesting weakness ahead but the Parabolic SAR and 20 DMA is also offering support. A SHORT position was taken at 122.40 following pivot high (124.04) and subsequent roll over and break of the rising channel from early November. Target 1 is the 23.6 Fibonacci level and previous resistance zone around 120.75, with Target 2 at the 38.2 Fibonacci level and 119.50.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2016/12/22 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.