Several factors have tempered recent optimism that lockdowns will be eased and economies will start to grow again. After Wall Street put in its best month since 1987 on those hopes, the indexes sagged again at the end of the week on worries that the reopenings of the states will be slow and disjointed, that there will be a second wave of the virus, and that consumption and production won’t get back to normal this year.

And adding to the uncertainties over the timing and extent of a bounce were weak data reports which started to capture more of the impacts and discouraged hopes for a quick, V-shaped bounce. Rather dismal outlooks from the Fed and ECB weighed on investor sentiment as well, even as the banks confirmed they are “all in” to support the financial markets. And finally, fears of resurgent US-China tensions added to the bearish tone as President Trump contemplates reparations.

Trump’s administration ratcheted up its accusations about China and the coronavirus pandemic, with the US Secretary of State Pompeo saying on Sunday that there was a “significant amount of evidence” that the virus emerged from a lab in Wuhan. Beijing, via an editorial in the state-controlled Global Times, responded by saying that the US was “bluffing.” Reports last week suggested that the White House is considering taking a number of measures against China, including new tariffs. It’s obvious that Trump’s motives for blaming China are high 6 months out from a presidential election, though the fraying relations between the two biggest economies is nevertheless a concern for investors.

Hence, as investors are re-thinking the hefty rally from April with fresh concerns about US-China relations, with data painting a picture of a deep contraction globally and expectations that they will be worse for Q2, hopes for a quick V-shaped recovery are being depressed.

That said, risk aversion is back on track with sentiment being taken by bears. Equities are sharply lower, paced by European bourses as they play catch-up to Friday’s US losses. The GER30 is about -3.5%, with US futures down -1%. In Europe, european rates are cheaper with the Bund up 3 bps to -0.562%, and spreads widened, despite further assurances from ECB vice president Guindos who stressed the ECB is committed to preventing fragmentation and tensions in markets.

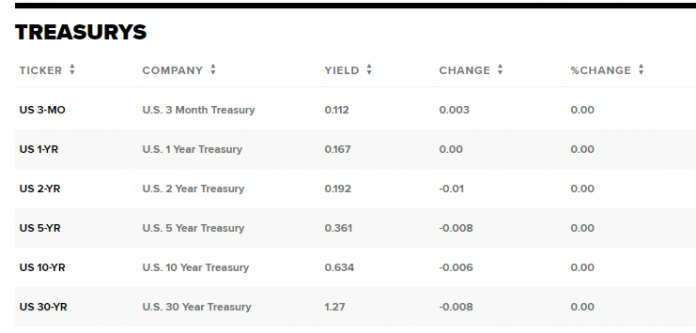

Attention should also turn to Treasury bills and the yield curve, since as repeated in the past, the yield curve can provide insights as to how investors believe the economy will evolve. The yield curve graphs the relationship between bond yields and bond maturity and as such it is a leading indicator for economic recession, recovery or even expansion.

For now the advent of supply, with the May refunding announcement on Wednesday, the further reduction in Fed purchases (now at $8 bln per day versus $10 bln), and yields near the lowest on record, have put a floor under rates. The 10- and 30-year yields are fractionally lower at 0.634% and 1.280%, while the 2-year is marginally higher at 0.200%, but inside narrow ranges over the past two weeks. The curve has been rather steady as well, currently at 44 bps, near the mid-point of the 36 bps to 52 bps range since late March.

Important! The relationship between bonds and equities is key for many reasons. An important one is simply the current chase for yield. When bond prices rise, that means bonds yields going down. As bond yields go down, equities become more appealing, as many solid companies are paying out regular dividends, which are often more than the yield on them.

Investors flock to equities, and equity prices rise in tandem with bond prices. Or, in other words, equity prices have an inverse relationship with bond yields, since the lower the yield on a bond, the higher the attractiveness of equities. Hence the recent decline of bond yields could be seen as supportive for Equity markets in the near term as investors were a bit optimistic in the near term.

Note that the Treasury announces its May refunding on Wednesday and is expected to outline a revived 20-year bond, on top of the usual slate of auctions.Treasury yields have cheapened 1-2 basis points following slight overnight richening on safe haven trades. Hence further decline could boost safe haven while a reversal could weigh on safe havens.

Always keep in mind that inter-market relationships govern currency price action.Bond yields serve as an excellent indicator of the strength of a nation’s stock market, which increases the demand for the nation’s currency and vice versa. For example, US bond yields gauge the performance of the US stock market, thereby reflecting the demand for the US Dollar. Additionally, by keeping an eye on bond spreads between two countries you could foresee changes in interest rates and you will have an idea where the currency pair (of those two countries) is headed.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.