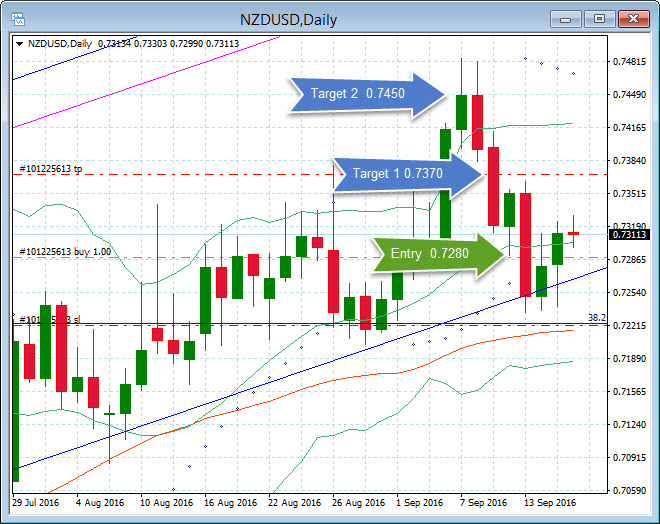

NZDUSD, Daily

The NZD has had a great 2016 so far and continues to look strong against the AUD and USD. The NZDUSD traded as low as 0.6328 back in January and since has rallied to its recent high on September 7 at 0.7484, a move of some 18%. The inevitable profit taking that was triggered by the Tweezer Top on September 8 and the subsequent move down to some long term support and Tweezer Bottom, tweaked my interest yesterday for a move to the LONG side. The support area around the confluence of the 50 DMA, 38.2 Fibonacci level and the long term monthly channel suggest evidence of further upside potential. The break and hold of the 20 DMA on yesterday’s weak US data confirmed the entry at 0.7280. Target 1, a little over the 14 Day ATR is at 0.7370 and Target 2 close to the recent high at 0.7450.

The Parabolic SAR remains negative as the pair trade below 0.7300 and any break of the 50 DMA and 38.2 Fibonacci level could move the pair lower. However, the RBNZ are expected to cut interest rates again before the year end following their 25 basis point cut (from 2.25% to 2.00%) in the Official Cash Rate last month. Governor Wheeler said at the time “…further policy easing may be required to ensure that inflation settles near the middle of the target range. We will continue to watch closely the emerging flow of economic data.” As the FED is widely expected to remain unmoved on rates next week the fundamentals remain positive for the Kiwi.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register for FREE! The next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2016/09/21 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.