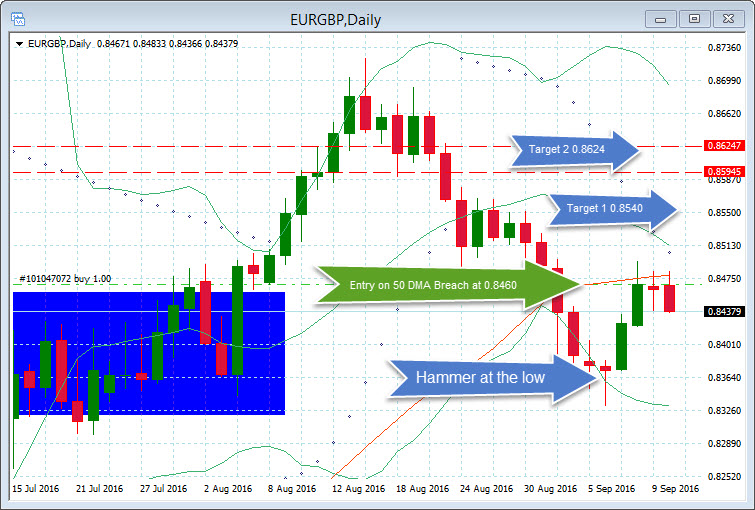

EURGBP, Daily

The EURGBP created a Hammer candle low on Tuesday (September 6) at 0.8332 from the recent high (August 12) at 0.8723. Two strong up days last week, through the 23.6 Fibonacci level and a touch of the 50 DMA and 38.2 Fib level spiked my interest on Friday. A close above the 0.8360 level on the Daily candle would generate a LONG position from here. Target 1 would be 0.8540 and Target 2 0.8624.

Sterling weakness may not translate into improved trade. The UK’s stats office last week downplayed the view that a July dip in the trade deficit was down to the weaker pound following the Brexit vote. The trade-weighted Sterling Exchange Rate Index dove 6.6% in July versus the average level in June, and was down by 15.0% versus July 2015 levels. Aside from noting month-to-month volatility in trade numbers, the ONS detailed the complexities in assessing the impact of currency levels on trade, highlighting that both export and import prices rose by over 3% in July, for instance. This fits the pattern seen during the pound’s weakness over 2008-2009 crisis period when the balance of trade in goods and services remained, according to the ONS, “broadly unchanged” both during and following a 25% depreciation in the trade-weighted value of the pound.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register for FREE! The next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2016/09/13 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.