FX News Today

European Outlook: Asian stock markets are mostly down (Nikkei closed below 17,000 down 0.32%) The Hang Seng is managing slight gains and mainland Chinese markets are narrowly mixed as volumes remain subdued amid official pressure on government backed funds to keep volatility down and limit sell offs. In Japan markets are assessing the prospects for further easing after better than expected GDP numbers. U.S. stock futures are higher after a narrowly mixed closed yesterday and FTSE 100 futures are also moving up. European stock markets already managed gains yesterday, led by Eurozone peripherals as markets hope for further easing from Draghi following weak German data this week. Eurozone yields fell going into the meeting and Bund futures are likely to remain supported ahead of Draghi, although the event risk is yet another disappointment if the ECB focuses mainly on dovish rhetoric and doesn’t rock the boat with extensive easing measures. Oil prices are higher and the front end WTI future is trading above USD 46 per barrel. Already released, the U.K. RICS house price balance came in much higher than anticipated and French non-farm payrolls were confirmed at 0.2%. The data calendar still has German labour cost data for Q2 ahead of tomorrow’s trade numbers.

BOE Governor Carney: The BOE action helped to reduce recession risk. The BoE governor said the U.K. recession risk has receded due to BoE actions, which clearly is a defence of the central bank’s easing package from August, but could also be seen as a sign that the additional rate cut that most MPC members still felt might be necessary back in August may not be necessary. Especially after this months round of better than expected confidence data. Still, Carney stressed that the BoE still has options for further easing if necessary, including another rate hike. Meanwhile, BoE officials sounded pretty unanimous in their rejection of Helicopter money, with Carney saying that he personally has ruled out helicopter money, Cunliffe saying it is “outside” his thinking and Vlieghe adding that such a step would not be a decision to the MPC as its a fiscal operation. However, quote of the day was Carney being “absolutely serene” about comments made by the central bank in the build-up to the Brexit vote. Cable closed the day at 1.3436 and currently trades down at 1.3330.

US JOLTS: The report showed job openings surged 228k to 5,871k in July, a new record high, following June’s 129 rebound to 5,643k (revised up from 5,624k). The rate edged up too, to 3.9% from 3.8%. Hirings increased 55k to 5,227k after the prior 125k jump to 5,227k (revised higher from 5,131k). The hire rate was steady at 3.6%. Quitters inched up 1k to 2,980k following the 37k June rise to 2,980k (revised up from 2,909k). The rate was unchanged at 2.1% (June revised up 2.0%). Fed Chair Yellen is a fan of the JOLTS report, and in particular the quit numbers, and though this report was better than expected, it is too backward looking to have much effect on the September rate decision, especially in the face of weaker, more contemporaneous numbers.

Fedspeak: Hawkish Richmond Fed’s Lacker argues for a September hike for which the “case is strong,” he said in House testimony. He noted that the Fed needs to make up ground on interest rates. This follows like-minded remarks from hawkish dissenter George of the KC Fed earlier, who also testified and said that the US is at or near full employment. It would be a surprise if either didn’t reiterate their hawkish views.

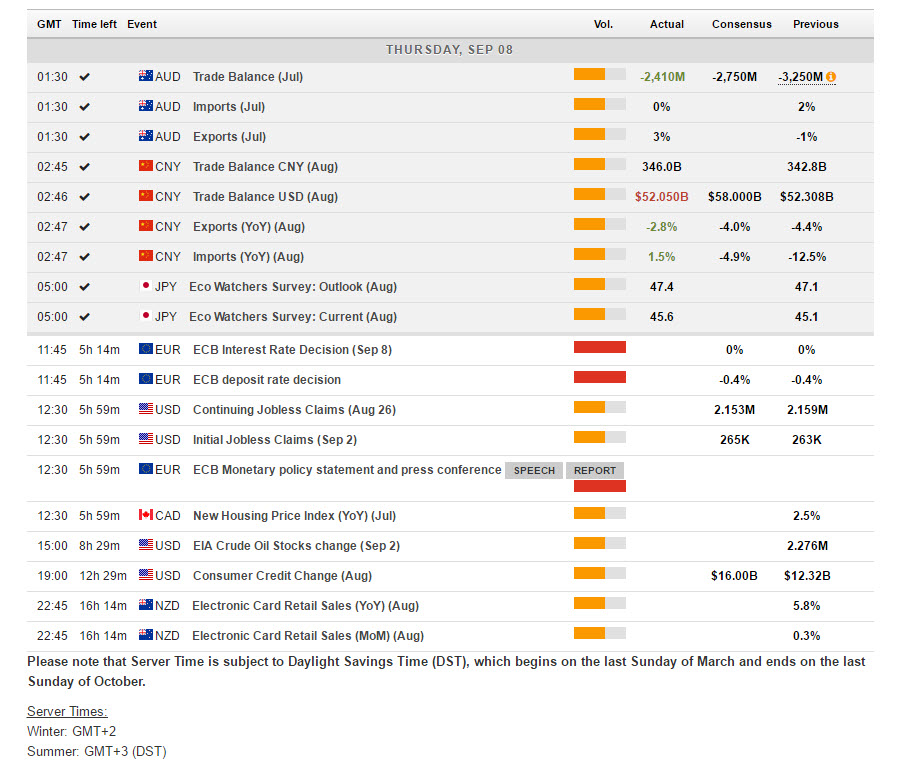

Main Macro Events Today

- ECB Rate Decision and Press Conference – 11:45 GMT & from 12:30 GMT – Not an easy meeting for the ECB, with mixed confidence indicators since the Brexit referendum, ongoing uncertainty about the future relationship between the U.K. and the EU, but also the outlook for the U.S. economy and the Fed rate path. This week’s round of disappointing German data will have been too late for the updated set of staff projections, but will only add to the arguments of the doves. At the same time, however, the ECB doesn’t have many options left if it doesn’t want to rock the boat. So for now the most likely scenario is dovish talk from Draghi and at the very best an extension of the time frame for QE maybe coupled with some minor tweaks to the QE program, including a possible removal of the deposit rate as the lower limit for purchases, which would help to address the increasing shortage of bonds, but at the same time push short term rates even lower. What is certain is that Draghi and Co will once again highlight the need for structural reforms and help from politicians in the struggle to boost Eurozone growth. Officials have been trying to limit expectations ahead of today’s meeting, but yields still fell and stocks moved higher in anticipation of further easing, so the event risk is a correction on both bond and stock markets, at least initially.

- US Jobless Claims – 12:30 GMT – Initial Claims are expected to rise a little to 265K from 263k and Continuing claims are expected to fall to 2.153 million from 2.159 million.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register for FREE! The next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2016/09/08 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.