AUDUSD, Daily

The Aussie and Kiwi dollars are outperforming so far today, showing respective gains of 0.6% and 0.8% against the USD. (See our Traders Board for details) Fitch’s AA rating for long-term New Zealand sovereign debt helped the Kiwi dollar higher, while gains in commodity prices have also been supportive for both the antipodean currencies. Expectations for a 25 bp rate cut by the RBNZ at its review tomorrow have been fully baked in. Yield differentials are also strongly in their favour relative to core developed-world benchmarks, which, in the case of Australia was given sharpened relevance by last week’s RBA Statement on Monday Policy which noted that CPI was expected to pick up “gradually to around 2% by the end of the forecast period,” signalling that the central bank may be done with easing following quarter-point cuts last week and in May.

Current intraday percentage change of currencies against other major currencies since the last daily close at 23:59:59 server time.

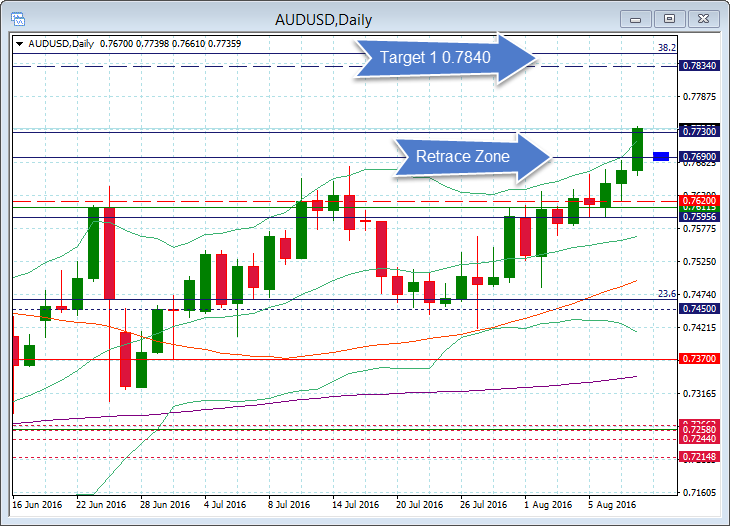

Technically, the AUDUSD remains in a strong up trend since it broke and held the 20 DMA (August 2), which offers a support area 0.7620-0.7590. The near two week rise from the 23.6 Fibonacci level and psychological 0.7450 level could lead to a re trace to 0.7690 before Target 1 at 0.7840 and Target 2 at 0.8000.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in: [ujicountdown id=”Next Webinar” expire=”2016/08/11 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.