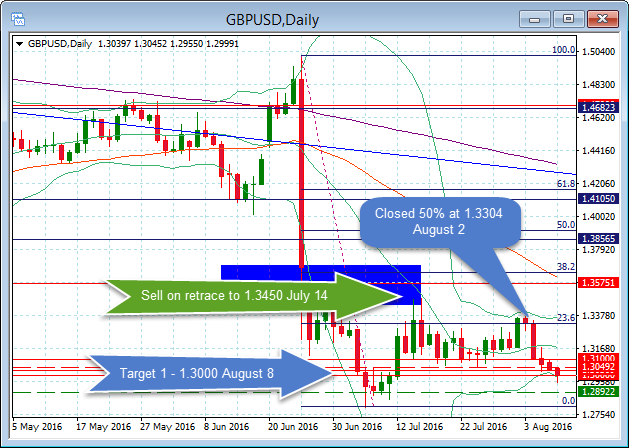

GBPUSD, Daily

At the beginning of the new quarter I wrote that I expected the Cable pair to head for “1.3000 and then down to 1.2500 and possibly as low as 1.2000 over the next few months but that the 1.3450 – 13650 level would probably have to be reached first. – On July 14th I posted The rally yesterday in GBPUSD pair generated a move into our sell area between 1.3450- 1.3650 and we are now SHORT from 1.3450. The pound remains 10.8% below the high seen just before the Brexit vote. This net loss reflects both uncertainty which itself disrupting economic activity, and the risk that Brexit will UK end up with, as the BoE put it yesterday in the minutes to its MPC meeting, a “persistent shift” in the UK’s terms of trade.

The sentiment has not really changed and Target 1 at 1.3000 was hit today. However, the net gain was 298 pips as the strength in sterling before the BOE move last week took the pair over the 23.6 FIB level and triggered half the position to be closed at 1.3304.

Sterling is the biggest loser for a second day out of the currencies we track, presently showing a 0.6% decline against both the dollar and yen, and a near 1% decline versus the euro, which is so far the day’s winner. UK data today were mixed, with the post-EU referendum July BRC retail survey an eyebrow lifter as it showed sales rose, while June production data came in near expectations and June trade numbers showed a hefty blowout in the goods deficit. Regarding the 1.1% jump in sales, the BRC managed find a dark lining to the silver cloud, noting that summer sales enticed consumers to spend after a weather-affected 0.5% drop in June sales while cautioning that “the big question for retailers is whether that success can be carried forward into full price sales.” Cable logged lows in Asia, again during the European AM session, and in New York AM trade, which we take as indicative of bearish momentum. The low so far is 1.2955, and the obvious target is the July-6 post-Brexit vote low at 1.2795.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in: [ujicountdown id=”Next Webinar” expire=”2016/08/11 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.